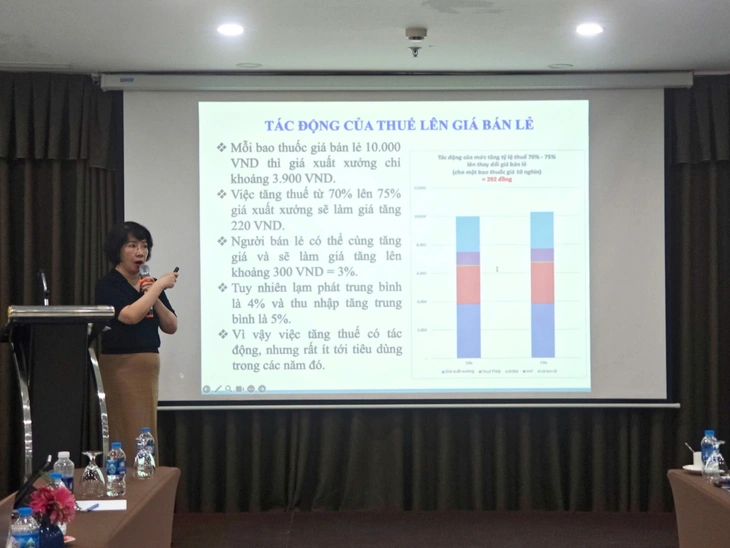

Ms. Phan Thi Hai shares at the program about the impact of tobacco tax on consumption - Photo: D.LIEU

This was shared by Ms. Phan Thi Hai, Deputy Director of the Tobacco Harm Prevention Fund, Ministry of Health , at the training program Some impacts of tobacco tax increase on people's health and market response, organized by the Vietnam Center for Economic and Strategic Studies (VESS) on April 23 in Hanoi.

More than 100 billion VND in medical examination and treatment costs related to tobacco

Ms. Hai said that tobacco use is one of the leading causes of illness and premature death. Tobacco contains 7,000 chemicals, including 69 carcinogens and is the cause of 25 diseases such as cancer, cardiovascular, respiratory and reproductive diseases.

In Vietnam, according to the World Health Organization (2021), tobacco use causes 85,500 deaths each year. Passive smoking causes 18,800 deaths and a total of 104,300 deaths/year due to tobacco-related diseases.

"Tobacco use has created a burden of disease, reducing the quality of the labor force. More than 45 million Vietnamese people are at risk of tobacco-related diseases and premature death due to direct smoking or exposure to secondhand smoke. Most of those who die from tobacco-related diseases are people of working age and die prematurely," Ms. Hai emphasized.

According to the preliminary estimate of the Vietnam Health Economics Association in 2022, the total cost related to medical examination and treatment, illness and premature death due to diseases related to tobacco use is 108,000 billion VND per year (equivalent to 1.14% of GDP in 2022). This figure is 5 times larger than the contribution of tobacco tax revenue to the national budget.

"From 2008 to 2019, Vietnam only increased the special consumption tax on cigarettes three times, but the tax increase each time was low, only 5%, and the time interval between tax increases was quite long (factory price).

Up to now, there are 40 cigarette brands on the market with retail prices under 10,000 VND/pack of 20 cigarettes, many brands are only priced at 7,000 - 8,000 VND/pack of 20 cigarettes.

With such low retail prices, cigarettes are very accessible to low-income people and new smokers, including children and adolescents," Ms. Hai emphasized.

Dr. Nguyen Ngoc Anh, director of the Center for Policy and Development Research, also said that according to statistics from 2008 to 2023, after the tobacco tax increases, production and export still increased and the number of consumers did not decrease.

If in 1994, consumers had to spend 31% of their income (year) to buy 100 packs of cigarettes, then in 2017, consumers only needed to spend 5.2% of their income (year) to buy 100 packs of cigarettes.

How to increase taxes effectively?

Regarding tobacco spending, economist Dao The Son said that some studies show that tobacco consumption is overwhelming education spending, especially in poor households. This also leads to tobacco spending consuming household budgets…

Increasing taxes can not only reduce the rate of users but also reduce lost working time due to illness and disease; reduce medical and environmental costs... Special consumption tax on cigarettes should be considered a fiscal policy to support economic growth.

"Vietnam needs to boldly increase special consumption tax to improve growth quality and sustainable growth.

"The tax should be increased from 5,000 VND/bag from 2026 (absolute tax) and gradually increased to 15,000 VND/bag by 2030," Mr. Son proposed.

According to Ms. Hai, to effectively reduce tobacco consumption, it is necessary to reform tobacco tax policy in the direction of adding absolute tax (to switch to a mixed tax system) at a large enough level.

At the same time, increase taxes on a regular basis so that cigarette prices keep up with income growth and gradually move towards the optimal tax rate of 75% of retail prices to contribute to the goal of reducing tobacco use rates.

"Regarding tax rates, we need to add an absolute tax on tobacco products of at least VND5,000 per pack by 2026 and gradually increase to VND15,000 per pack by 2030, in addition to the current proportional tax," said Ms. Hai.

Read more Back to Homepage

Back to topic

WILLOW

Source: https://tuoitre.vn/hon-45-trieu-nguoi-viet-co-nguy-co-mac-benh-vi-khoi-thuoc-la-202504231016039.htm

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

Comment (0)