At major US banks, bad commercial real estate loans have exceeded loss provisions after late payments related to offices, shopping malls and other properties surged.

Average reserves at JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley fell from $1.60 to 90 cents for every dollar of commercial real estate debt that was at least 30 days delinquent, according to data from the Federal Deposit Insurance Corporation (FDIC).

Bank supervisors at the US Federal Reserve and regulators are now focusing on closely monitoring banks' commercial real estate (CRE) lending, including risk reporting and appropriate capital arrangements to limit potential future CRE lending losses.

Across the US banking system, the value of delinquent loans tied to offices, shopping malls, apartments and other commercial properties has risen to $24.3 billion, more than double last year.

U.S. banks now hold $1.40 in reserves for every dollar of delinquent commercial real estate loans, down from $2.20 a year ago, according to FDIC data. The least insured banks have been exposed to potential commercial real estate loan losses for more than seven years.

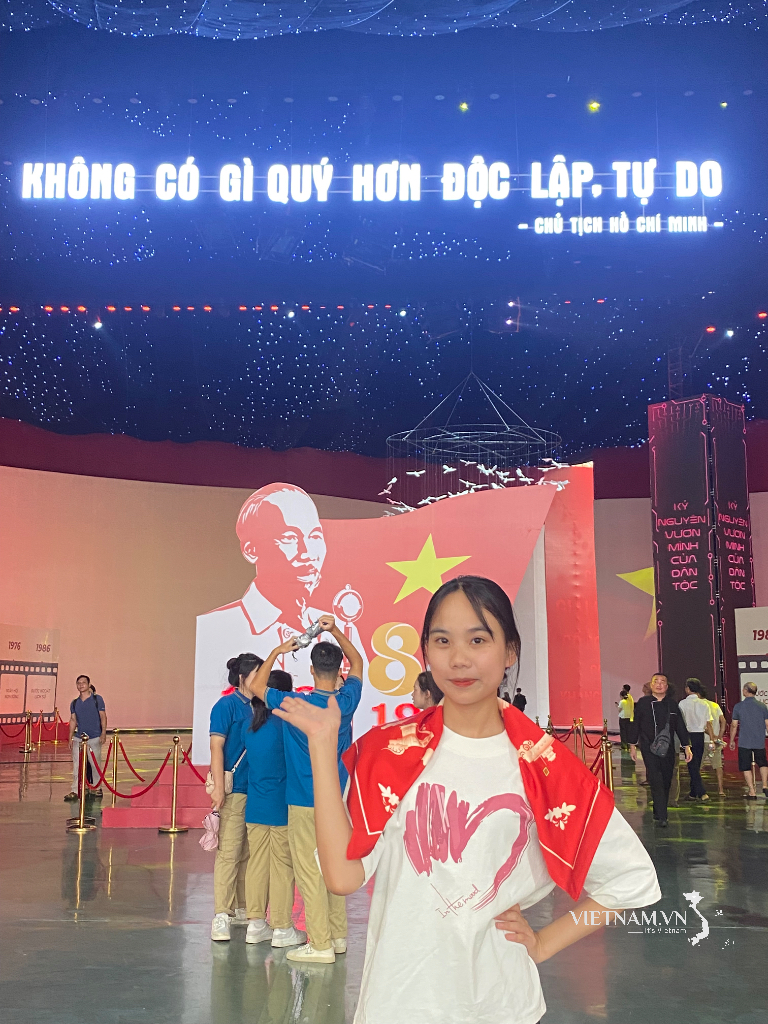

MINH CHAU

Source

![[Photo] Da Nang: Hundreds of people join hands to clean up a vital tourist route after storm No. 13](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/07/1762491638903_image-3-1353-jpg.webp)

Comment (0)