MarketVector will officially announce the results of the Vietnam Local Index (VNM ETF) component portfolio on December 12, 2025, and it will take effect on December 19, 2025. This is the index set being simulated by the VanEck Vietnam ETF fund.

Some changes of the Vietnam Local Index in this announcement compared to the last announced list are as follows:

ACBS said that in the announcement period of the fourth quarter of 2025, the Vietnam Local Index is expected to not change its basket of components, only adjusting the current stock weight structure.

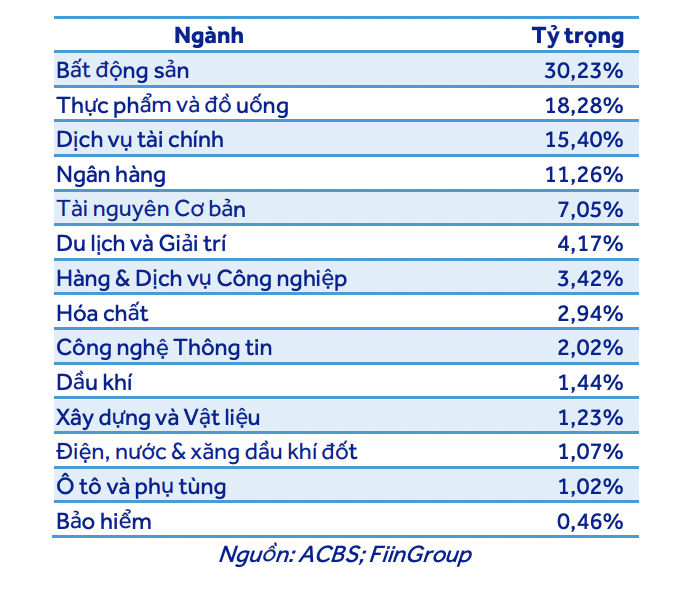

|

| Portfolio weighting of VanEck Vietnam ETF by sector |

Currently, the VanEck Vietnam ETF fund has total assets of 573.41 million USD, equivalent to 15,144 billion VND. In this restructuring, it is estimated that the fund will make transactions of nearly 3,000 billion VND in both buying and selling.

In which, VIC is the stock that will significantly reduce its weight from 15.5% to 8% (the weight limit of individual stocks); conversely, VCB is the stock that will significantly increase its weight from 3.8% to 5%.

VIC was the most net sold, with an expected buying and selling volume of nearly 4.4 million shares, equivalent to a selling value of about VND 1,134 billion; followed by HVN with 3.3 million shares. On the other hand, SSI is expected to be strongly net bought with 4.5 million shares, estimated at nearly VND 147 billion. Most of the shares are expected to be restructured by this fund within 1 trading session, except for HVN (3.4 sessions) and SBT (1.4 sessions).

Previously, MBS also predicted changes in the fourth quarter restructuring period of the two index funds VNM ETF and STOXX ETF, in which VIC is a stock that is likely to be sold by VNM ETF to reduce its weight.

Two ETF index funds, STOXX Vietnam (formerly FTSE Vietnam Index) and MarketVector Vietnam Local Index (VNM ETF), with total capital under management of nearly 1.2 billion USD, will announce their portfolio composition on December 5 and December 12, respectively. The portfolio restructuring period is from December 15 to December 19.

With data as of November 21, MBS expects the STOXX Vietnam index fund to only change the proportion of component stocks in the index basket.

For VNM ETF, the stocks in the current portfolio still meet the evaluation criteria such as capitalization over 3,600 billion, average 3-month trading value over 1 million USD, or foreign room of at least 5%, so there will be no stocks eliminated due to not meeting any of the criteria.

However, MCH is likely to be added with about 1.7 million shares purchased because in the last quarter, MCH's liquidity and capitalization increased sharply to meet the index criteria.

On the selling side, MBS believes that because VIC's share price has increased sharply, bringing VIC's weight beyond the 8% limit, it will almost certainly be under pressure to reduce its weight in this restructuring period with about 4 million shares being sold.

Summarizing the restructuring activities of both ETFs in December, notable stocks that can be bought include: MCH (1.7 million shares, equivalent to 3.18 trading days), PVS, PVS each stock is about more than 2.5 million shares. On the other hand, VIC, POW, HUT are notable stocks that are sold.

Source: https://baodautu.vn/quy-vaneck-vietnam-etf-du-kien-giam-ty-trong-co-phieu-nha-vingroup -d449326.html

![[Photo] 60th Anniversary of the Founding of the Vietnam Association of Photographic Artists](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F05%2F1764935864512_a1-bnd-0841-9740-jpg.webp&w=3840&q=75)

![[Photo] National Assembly Chairman Tran Thanh Man attends the VinFuture 2025 Award Ceremony](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F05%2F1764951162416_2628509768338816493-6995-jpg.webp&w=3840&q=75)

Comment (0)