Tax Department ( Ministry of Finance ) - Photo: VGP/HT

Ensuring continuity in the context of administrative boundary changes

Tax industry leaders said: After some localities reorganized administrative units at district and commune levels, leading to changes in addresses, tax authorities have synchronously deployed solutions to support taxpayers, especially businesses, organizations, and enterprises in using electronic invoices in accordance with the 2-level local government model.

Firstly, the tax authority has directed the local tax authority to notify the taxpayer about updating the address according to the new administrative area. The information is transmitted through official channels such as the taxpayer's electronic tax transaction account, registered email address and the eTax Mobile application of the legal representative.

At the same time, the tax authority also noted: In some cases, the address on the electronic invoice has been updated according to the new administrative area, but the address on the Business Registration Certificate is still the old address. In this situation, taxpayers can completely use the tax authority's notices to explain to partners or relevant agencies.

At the same time, the Tax Department has increased coordination with media and press agencies to promote and answer questions related to declaring address information when using electronic invoices in accordance with the new model.

Second, to reduce administrative procedures and facilitate businesses, the tax authority has coordinated with the business registration authority to unify instructions: organizations, businesses, and business households are not required to update their business registration addresses according to new administrative boundaries. This instruction is specified in Official Dispatch No. 4370/BTC-DNTN of the Ministry of Finance. Official Dispatch No. 4370/BTC-DNTN of the Ministry of Finance provides instructions on business registration in case of changes in administrative boundaries.

Third, the tax authorities have regularly worked and closely coordinated with e-invoice solution providers to upgrade the software in a timely manner, ensuring that e-invoices display addresses according to the new administrative area. Thanks to that, taxpayers can conveniently issue invoices without interruption or problems arising in the process of fulfilling tax obligations and production and business activities.

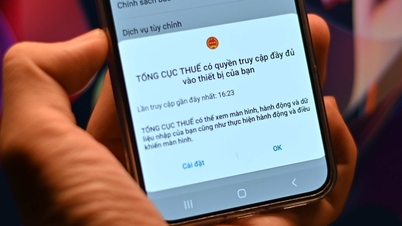

Warning about fake tax authorities, instructions for businesses to protect information

Along with the process of arranging the 2-level local government model, some subjects have taken advantage of the situation to impersonate tax authorities, sending fake information via phone, email or text message to defraud organizations, businesses and business households. To protect taxpayers from this risk, the tax authorities have issued many specific recommendations.

First of all, the tax authority affirms that it does not require taxpayers to provide Citizen Identification Cards, Tax Registration Certificates or Business Registration Certificates to update information according to the 2-level local government model. Information updates are done internally through the database and official notices are sent to taxpayers.

Therefore, organizations, enterprises and business households need to be vigilant, absolutely do not provide information to suspicious subjects, and do not follow instructions from unofficial information sources.

In addition, if the enterprise needs to update the address according to the new administrative boundaries on the Business Registration Certificate, it must contact the business registration agency directly for specific instructions according to current regulations. This update is not mandatory, but if done, it must comply with standard procedures to avoid being exploited.

In case of problems with electronic invoices or need to clarify tax policies related to changes in administrative models, taxpayers are encouraged to contact directly the hotline or phone number, email of tax officials for support - information has been made public on the Tax Department's Electronic Information Portal.

Mr. Minh

Source: https://baochinhphu.vn/van-hanh-thong-suot-hoa-don-dien-tu-khi-chuyen-mo-hinh-chinh-quyen-dia-phuong-2-cap-102250714184135241.htm

![[Photo] The 5th Patriotic Emulation Congress of the Central Inspection Commission](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761566862838_ndo_br_1-1858-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man receives Chairman of the House of Representatives of Uzbekistan Nuriddin Ismoilov](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761542647910_bnd-2610-jpg.webp)

![[Photo] Party Committees of Central Party agencies summarize the implementation of Resolution No. 18-NQ/TW and the direction of the Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761545645968_ndo_br_1-jpg.webp)

Comment (0)