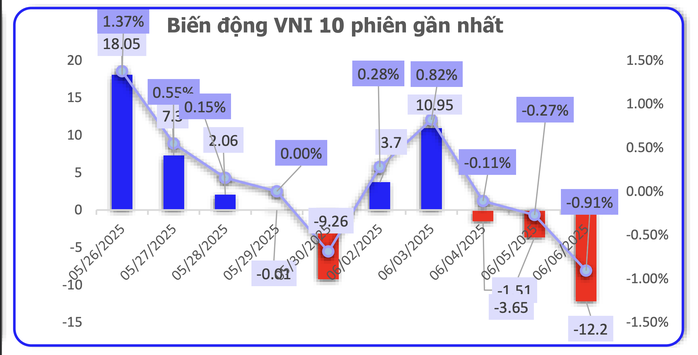

After 4 consecutive weeks of increasing points, bringing VN-Index to the 1,340 - 1,350 point range, the highest level in more than 3 years, the stock market has begun to show signs of slowing down. Increasing selling pressure in the last sessions of the week caused the main index to fall for 3 consecutive sessions. At the end of the week, VN-Index decreased slightly by 0.2%, falling back to 1,329.89 points.

According to Mr. Nguyen Thai Hoc, an analyst at Pinetree Securities Company, this is the first week of adjustment after a long increase. Although the decrease is not large, when looking at the cash flow and technical signals, it can be seen that the market sentiment has become more cautious.

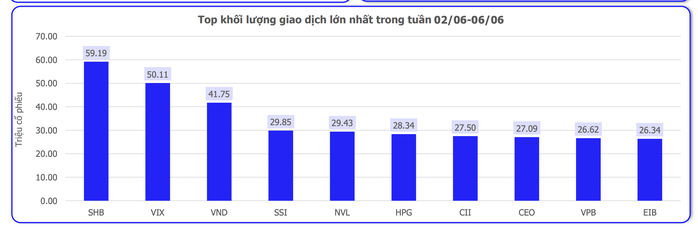

He believes that the risk of short-term correction is becoming increasingly clear, because current cash flow mainly rotates between large industry groups and only focuses on a few stocks with their own stories.

In fact, after the banking stocks attracted cash flow, interest shifted to real estate, then to securities and the electricity industry. However, Mr. Hoc noted that if pillar stocks, especially those in the Vingroup ecosystem such as VIC, VHM, and VRE, all adjust, the VN-Index may face even stronger selling pressure.

The stock market is under pressure to correct after 4 consecutive weeks of increase.

Many investors shared that although the market has increased for four consecutive weeks, their portfolios have not yet "reached the shore". In just the last few sessions, when the index slightly decreased, stocks have followed suit, causing widespread anxiety. This reflects the fact that many stocks in the securities, real estate and banking groups have not yet recovered to the price level before the plunge in early April.

Experts from SHS Securities Company believe that the market is entering June - a time of many unpredictable factors, when trade and tariff negotiations between the US and other countries are in the final stages. These changes in tax policies may begin to affect business results of enterprises, thereby affecting stock prices. According to forecasts, the market needs time to find a new equilibrium price zone, especially for industries affected by taxes.

SHS also believes that VN-Index may return to test the support zone around 1,300 points. Investors are advised to be cautious in disbursing, and need to carefully evaluate short-term portfolios to have a reasonable restructuring plan.

Source: CSI

Mr. Nguyen Thai Hoc emphasized that the market is still "holding its breath" waiting for clearer supporting information, especially the results of the tax negotiations between Vietnam and the US. In this context, the possibility of the index continuing to break out is quite low.

If the market falls into a negative scenario, the VN-Index may fluctuate strongly and fall back to the support zone of 1,280 - 1,300 points. At that time, selling pressure may increase, especially in large-cap stocks such as banks or codes belonging to the Vingroup ecosystem. This is a point to note for investors to adjust their strategies accordingly.

Meanwhile, Mr. Dinh Quang Hinh, Head of Macro and Market Strategy at VNDIRECT Securities Company, said that the upcoming period will be a "crucial" time with many important events. Notably, the US Federal Reserve's (FED) policy meeting in mid-June and the deadline for negotiating reciprocal taxes in early July.

Mr. Hinh believes that in this context, the top priority for investors should be to preserve profits and manage portfolio risks. Obviously, after a strong increase, the stock market is entering a challenging period. Maintaining a stable mentality, choosing stocks carefully and managing the portfolio carefully will be the key to helping investors overcome the volatile period ahead.

Source: CSI

Source: https://nld.com.vn/vn-index-dang-vao-giai-doan-kho-luong-nha-dau-tu-lam-gi-de-tranh-bi-xo-xa-bo-196250608094814331.htm

![[OCOP REVIEW] Tu Duyen Syrup - The essence of herbs from the mountains and forests of Nhu Thanh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/5/58ca32fce4ec44039e444fbfae7e75ec)

Comment (0)