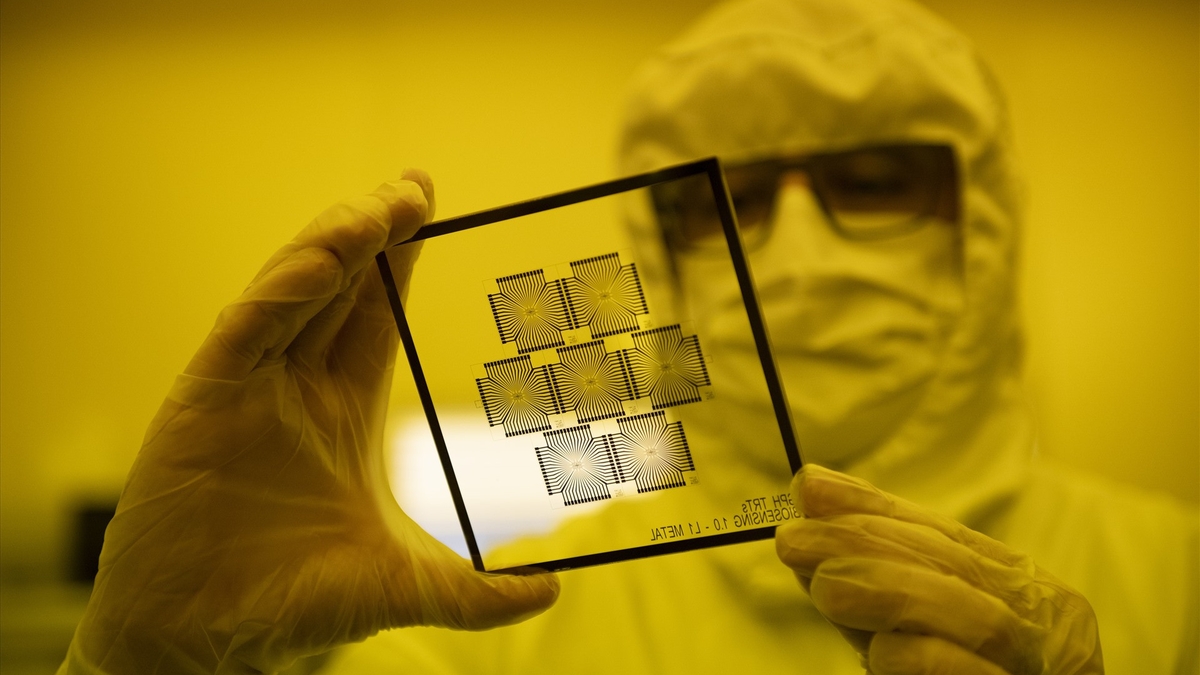

To balance cash flow, many businesses choose to liquidate real estate assets - Photo: QUANG DINH

Continuously selling assets

For example, at SMC Investment and Trading Joint Stock Company, the board of directors of the enterprise continuously decided to transfer assets to restructure business operations.

Most recently, this company approved the transfer of land use rights and assets attached to land at SMC Danang LLC.

The above land lot is located in Cam Le district, Da Nang city, with an area of 27,731m2. The expected transfer price is more than 96 billion VND. In the difficult context, SMC has had to continuously sell assets. In November 2023, SMC sold land and assets at SMC Binh Duong .

In mid-April this year, SMC's Board of Directors approved a resolution to transfer land use rights and ownership of houses and properties attached to land at 681 Dien Bien Phu for VND170 billion. This is also the company's headquarters.

Regarding the business situation, the 2024 semi-annual financial report recorded that SMC's accumulated loss had decreased from 168 billion VND at the beginning of the year to more than 68 billion VND at the end of June. SMC's revenue in the first half of this year still decreased sharply compared to the same period, reaching 4,471 billion VND.

However, thanks to asset liquidation and a significant reduction in interest expenses, SMC had a profit after tax of VND89 billion, while in the same period last year it lost up to VND385 billion.

Another enterprise in the garment industry is also struggling to survive by liquidating assets, that is Garmex Saigon Joint Stock Company (GMC).

GMC has no source of goods. To have cash flow, the company continuously sells machinery, equipment, and real estate in Quang Nam and Ba Ria – Vung Tau provinces.

In the 2024 semi-annual report, the independent auditor said that Garmex has stopped production and business since May 2023.

The company has restructured its workforce, liquidated unused assets, contributed capital to invest in projects, made efforts to recover debts, and added new business lines to restore production.

Up to this point, asset liquidation notices are still tightly covered on Garmex's information page.

In the financial report, at the end of June 2024, Garmex still recorded an accumulated loss of nearly 73 billion VND. Revenue continued to decline sharply, only 358 million VND in the first half of this year. Meanwhile, in a good business period like 2021, revenue exceeded thousands of billions of VND.

A corporation has a roadmap to liquidate billion-dollar assets.

Although Novaland has been struggling for a long time, the announcement of its 2024 semi-annual financial report, which changed from a profit of VND 345 billion to a loss of more than VND 7,300 billion, still left many shareholders stunned.

In the audited report, the independent auditor recorded a lot of information related to debt restructuring and maintaining Novaland's operations.

Accordingly, the group will liquidate assets with a total amount of VND25,439 billion (more than 1 billion USD). Of which, one asset was successfully sold by the group and earned VND1,000 billion.

In addition, Novaland also signed principle contracts for the sale of 7 assets with a total value of VND 12,363 billion; and signed memorandums of understanding for the sale of 3 assets with a total value of VND 9,100 billion.

Novaland has also received non-binding offers from buyers for the sale of three assets with a total value of VND1,982 billion.

Recently, many listed enterprises have been continuously selling off capital, transferring investments or shifting to new business directions.

As Duc Long Gia Lai Group Joint Stock Company (DLG) will divest all of their capital contributions at Mass Noble Company. After completing the divestment procedures, Mass Noble is no longer a subsidiary of Duc Long Gia Lai Group. Duc Long Gia Lai said that the company has invested more than 249 billion VND, equivalent to holding 97.73% of Mass Noble's charter capital.

Or like Saigon Thuong Tin Real Estate JSC continuously dissolved its subsidiaries in the real estate sector to restructure the business.

Meanwhile, Vu Dang Investment and Trade JSC has approved the policy of investing and developing real estate projects in addition to maintaining its main business of fiber production.

![[Photo] Da Nang: Hundreds of people join hands to clean up a vital tourist route after storm No. 13](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/07/1762491638903_image-3-1353-jpg.webp)

Comment (0)