iShares MSCI Frontier and Select EM ETF withdrew $60 million from Vietnam in mid-June

Although the iShares MSCI Frontier and Select EM ETF will not close until August 12 at the earliest, the fund is moving money out of Vietnam in addition to reducing the proportion of Vietnamese stocks it holds.

|

The net asset value (NAV) of iShares MSCI Frontier and Select EM ETF has been continuously decreasing over the past week. Updated to June 14, the fund's NAV is just over 382.4 million USD (equivalent to nearly 9,730 billion VND). In the past 2-3 days, this fund has moved to transfer money back to the country by increasing its investment proportion in BlackRock Cash Funds - BCF Treasury Fund - an investment fund with at least 99.5% of its portfolio value in cash (USD), US Treasury bills, US Treasury bonds...

As of June 14, the value of investment in fund certificates of BlackRock Cash Funds was approximately 153.34 million USD, accounting for 40.33% of the total asset value of the fund. Meanwhile, cash in VND has decreased sharply from 62 million USD on June 11 to more than 2.2 million USD on June 14. Correspondingly, there has been about more than 1,500 billion VND withdrawn from Vietnam.

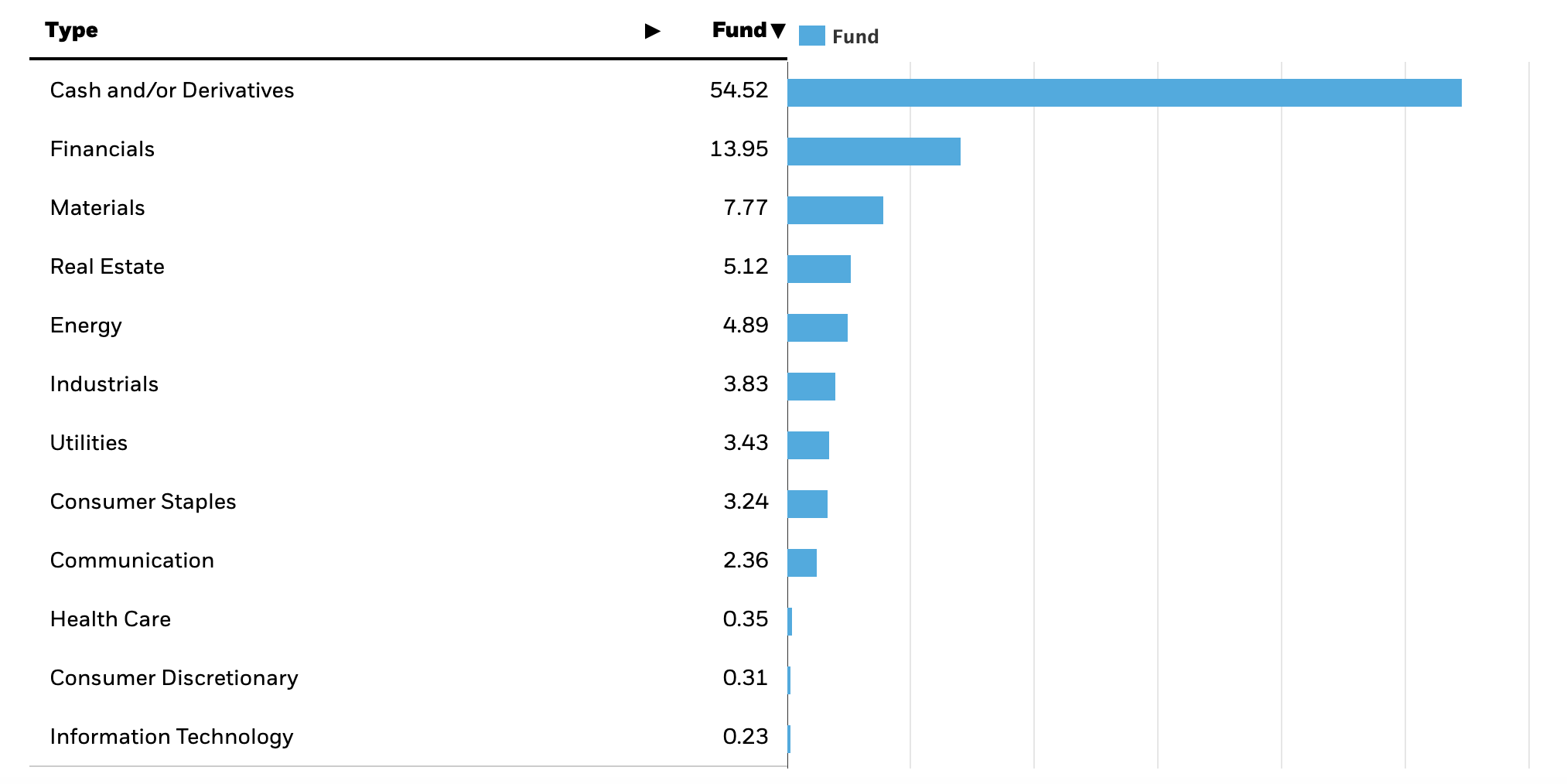

In other currencies, the cash and derivatives weighting in this ETF portfolio is oversold.

|

| Portfolio structure of iShares MSCI Frontier and Select EM ETF as of June 13 - Source: BlackRock |

iShares MSCI Frontier and Select EM ETF quickly reduced its stock weight and increased cash after the BlackRock Asset Management Group decided to dissolve the fund. Previously, the group announced its decision to dissolve the iShares MSCI Frontier and Select EM ETF - an ETF specializing in investing in frontier and emerging markets established in 2012. The fund is expected to hold the majority of its assets in cash and cash equivalents during the extended liquidation period. The closing date is no earlier than August 12, 2024. Currently, the above ETF is expected to stop trading and, at the same time, no longer accept creation and redemption orders after the market closes on March 31, 2025. The proceeds from the liquidation are expected to be sent to shareholders within three days after the last trading day.

The iShares MSCI Frontier and Select EM ETF was originally named iShare MSCI Frontier Markets 100 ETF and referenced the MSCI Frontier Markets 100 Index. However, in March 2021, the fund changed its name and used the MSCI Frontier & Emerging Markets Select Index as a reference. This move three years ago was actually intended to increase attractiveness and attract more investors to buy fund certificates.

According to Mr. Pham Luu Hung - Chief Economist of SSI Securities, the fact that the largest fund of the frontier market has closed also shows that Vietnamese securities need to make more efforts to achieve the goal of upgrading.

“Vietnam cannot remain in the frontier market forever because if it stays, it will not receive any benefits. Therefore, all parties need to be more proactive in the goal of upgrading the market,” Mr. Hung said.

Regarding the impact of iShares MSCI Frontier and Select EM continuing to withdraw capital from the Vietnamese stock market, Mr. Hung assessed that it would not have much impact given the current size of the remaining shares.

According to the portfolio structure as of June 14, HPG is the Vietnamese stock that the fund still holds the most with a market value of nearly 6.1 million USD, equivalent to 154 billion VND. At the current market price, the number of shares is approximately 5.2 million HPG shares. In addition, the fund owns VHM (3.85 million USD), VNM (3.46 million USD), VIC (3.43 million USD), MSN (3.37 million USD), SSI (2.48 million USD), VCB (2.23 million USD), DGC (1.4 million USD), VRE (1.33 million USD), ... In total, the value of Vietnamese stocks accounts for 14.29% of the portfolio of iShares MSCI Frontier and Select EM.

Source: https://baodautu.vn/ishares-msci-frontier-and-select-em-etf-rut-60-trieu-usd-khoi-viet-nam-giua-thang-6-d217827.html

![[Photo] Da Nang: Hundreds of people join hands to clean up a vital tourist route after storm No. 13](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/07/1762491638903_image-3-1353-jpg.webp)

Comment (0)