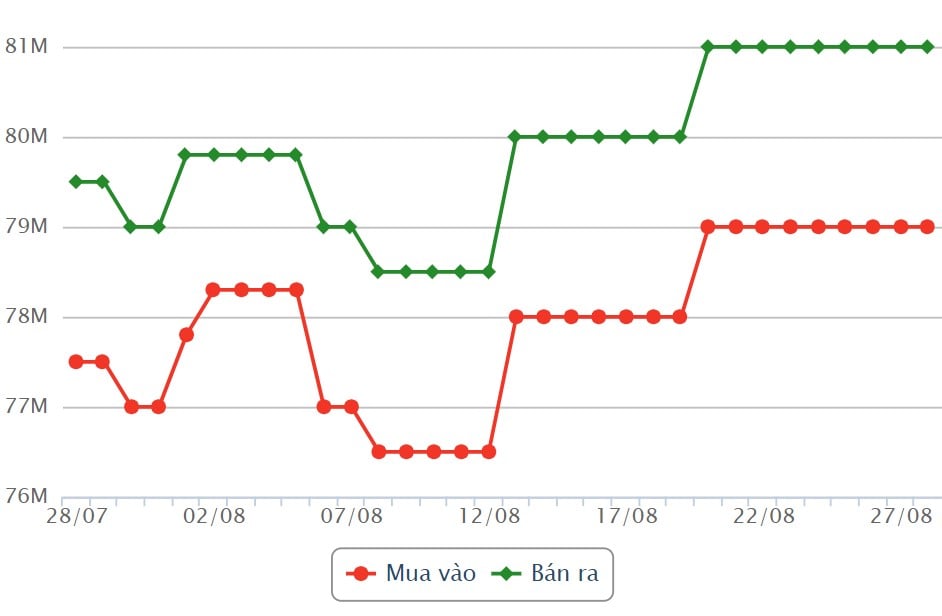

SJC gold bar price

As of 9 AM, the price of SJC gold bars listed by DOJI Group was 79 - 81 million VND/ounce (buying price - selling price).

Compared to the beginning of the previous trading session, the price of gold at DOJI remained unchanged for both buying and selling.

The difference between the buying and selling price of SJC gold at DOJI Group is around 2 million VND/ounce.

Meanwhile, Saigon Jewelry Company (SJC) listed the price of SJC gold at 79 - 81 million VND/ounce (buying price - selling price).

Compared to the beginning of the previous trading session, the price of gold at Saigon Jewelry Company (SJC) remained unchanged for both buying and selling.

The difference between the buying and selling price of SJC gold at Saigon Jewelry Company (SJC) is around 2 million VND per tael.

Price of 9999 gold rings

This morning, the price of 9999 Hung Thinh Vuong gold rings at DOJI was listed at 77.55 - 78.65 million VND/ounce (buying price - selling price); an increase of 100,000 VND/ounce in both buying and selling prices.

Saigon Jewelry Company listed the price of gold rings at 77.4 - 78.65 million VND/ounce (buying price - selling price); an increase of 100,000 VND/ounce in the buying price and unchanged in the selling price.

In recent trading sessions, the price of gold rings has often fluctuated in the same direction as the global market. Investors can refer to the global market and expert opinions before making investment decisions.

World gold prices

As of 9:30 AM, the world gold price listed on Kitco was at $2,516.1 per ounce, an increase of $9.1 per ounce compared to the beginning of the previous trading session.

Gold price forecast

Global gold prices rose despite the recovery of the US dollar index. At 9:45 AM on August 28th, the US Dollar Index, which measures the fluctuations of the greenback against six major currencies, stood at 100.575 points (up 0.12%).

The recent surge in gold prices comes amid improving consumer sentiment. The US consumer confidence index for August painted a more optimistic picture, rising to 134.4 from 133.1 in July.

The catalyst for the weakness of the USD/ounce may have originated in late June when optimism began to build around the possibility of the US Federal Reserve (FED) pivoting toward interest rate normalization.

This sentiment was reinforced by the recent speech by FED Chairman Jerome Powell at the Jackson Hole Economic Symposium in Wyoming. Powell's remarks effectively confirmed that the era of aggressive interest rate hikes, which began in March 2022, has ended, with the first interest rate cut likely to occur in September of this year.

The market is expecting a US interest rate cut. According to CME's FedWatch tool, 66% forecast a 0.25% cut in September, with 34% predicting a 0.5% cut.

This anticipated shift in monetary policy has significant implications for the gold market, reinforcing its position as a safe-haven asset and a hedge against economic instability.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-hom-nay-288-tang-vung-chac-vang-nhan-ap-sat-dinh-moi-1385839.ldo

![[Image] Vietnam's colorful journey of innovation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F14%2F1765703036409_image-1.jpeg&w=3840&q=75)

Comment (0)