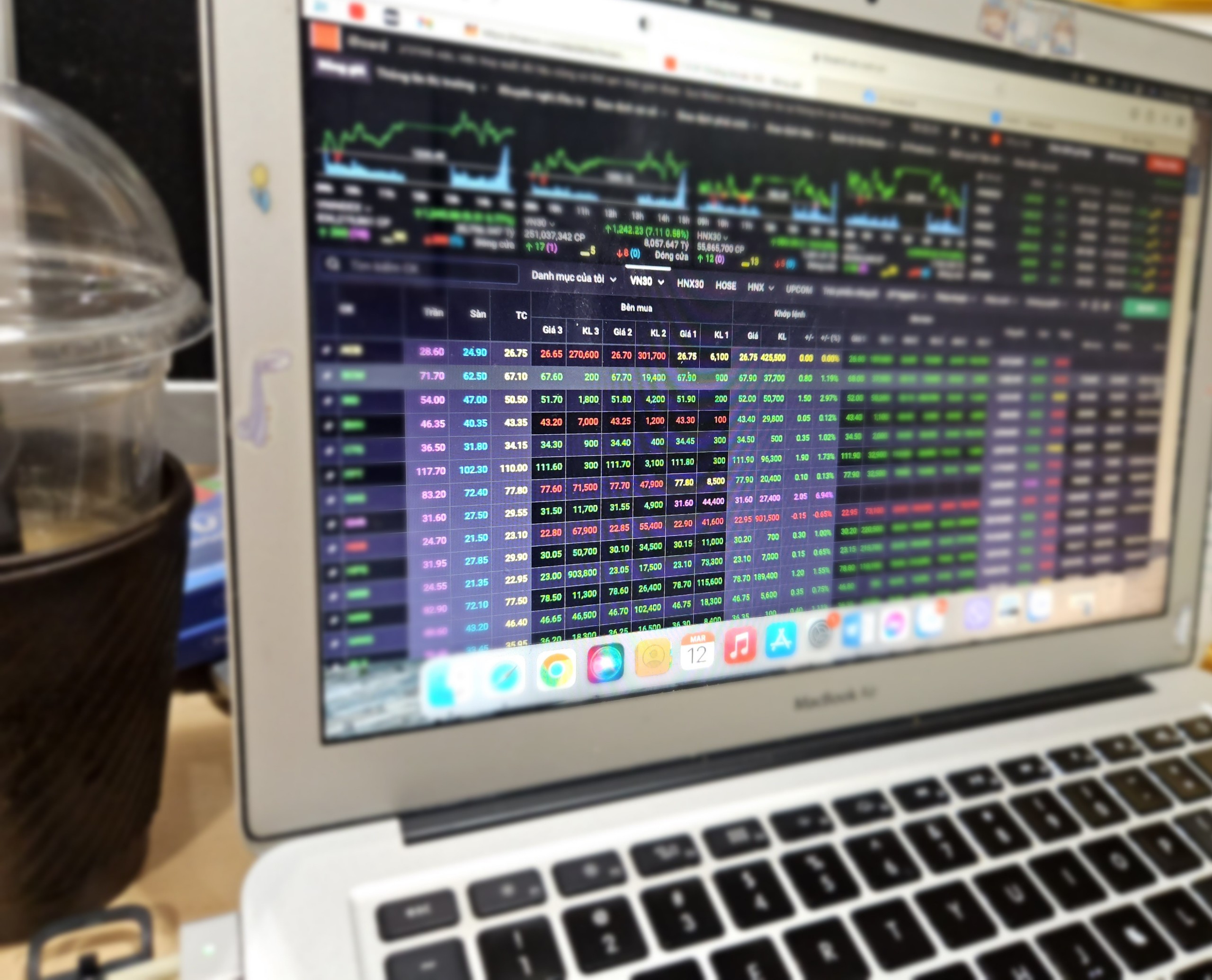

(NLĐO) - The market is fluctuating, foreign investors are net sellers, and capital flows are strongly diversified, concentrating on stocks with promising profit growth prospects at the end of the year.

On December 10th, despite the market opening in positive territory, increased selling pressure prevented the VN-Index from maintaining its gains. Profit-taking pressure caused the index to continue fluctuating.

The VN-Index closed at 1,272.07 points, down 1.77 points; the HNX-Index rose 0.03 points, closing at 229.24 points. Across the market, 223 stocks declined and 170 stocks increased. Foreign investors continued their net selling streak for the second consecutive session, with net selling exceeding 132 billion VND.

Stocks contributing significantly to the gains includedFPT , HDB, HPG, HVN, and SAB; stocks contributing to the decline included VCB, VIC, VHM, and GVR…

The total value of matched transactions on the VN-Index reached over 14,400 billion VND, a decrease of 9.9% compared to the previous session. According to securities companies, market capital flows showed signs of diversification and concentration on shares of companies expected to have positive business results in the last quarter of the year.

The stock market continued to fluctuate and showed signs of a downward correction after several positive sessions.

Mr. Vo Kim Phung, Head of Analysis Department at BETA Securities Company, noted that capital flows are cautious as the index approaches the old resistance zone around 1,270 points. Foreign investors continue to net sell, affecting the sentiment of domestic investors. Although the short-term trend of the VN-Index remains positive, it needs time to accumulate and await information on US interest rate policy.

"The flow of money is diversified, actively seeking profit opportunities in the market. Investors can consider accumulating shares of companies with good fundamentals and promising growth potential in the last quarter of 2024 and 2025 during periods of volatility and correction. Avoid chasing after stocks that show signs of overheating, are far from their accumulation base, and whose valuations are no longer attractive," Mr. Phung said.

Vietnam Construction Securities Company (CSI) also believes that profit-taking pressure has increased after the past three consecutive days of gains for the VN-Index. However, the decline is not significant and liquidity has decreased, so the market remains positive. Investors need to be patient and wait for corrections to support levels to increase their stock holdings and open new buying positions.

According to experts at Phu Hung Securities Company, capital tends to flow into mid- and small-cap stocks in sectors such as mining, shipping, real estate, media, pork, and steel. The VN-Index may correct downwards for a few sessions. The general strategy is for investors to gradually re-enter the market with moderate weighting, prioritizing sectors such as banking, textiles, seafood, fertilizers, shipping, and technology.

Source: https://nld.com.vn/chung-khoan-ngay-11-12-dong-tien-chay-vao-co-phieu-nao-196241210174736687.htm

Comment (0)