|

| VN-Index increased strongly in the afternoon session, surpassing the 1,717 point mark. |

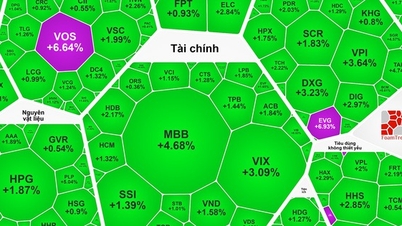

However, in the afternoon session, the situation changed significantly. Cash flow actively returned, bottom-fishing demand appeared strongly in the banking group, securities and large-cap stocks, helping VN-Index quickly escape the bottom and reverse to increase points. Improved liquidity and expanded market breadth showed that investor sentiment was more stable, the recovery momentum was consolidated.

At the end of the session, the VN-Index increased by 15.39 points to 1,717.06 points, equivalent to an increase of 0.9%. From the bottom of a decrease of more than 11 points in the morning, the index recovered by 1.58% in the afternoon session. The VN30 basket continued to play a leading role when green dominated, contributing nearly half of the overall increase. On the Hanoi Stock Exchange, the HNX-Index increased by 0.37% to 258.87 points, and the UPCoM-Index increased by 0.46% to 119.69 points, reinforcing positive sentiment.

The biggest mark in the afternoon recovery came from the group of blue-chip stocks. VIC reversed dramatically when it decreased by 1.07% at the end of the morning session to increase by 1.89% at the close, corresponding to a reversal amplitude of nearly 3%. VIC liquidity in the afternoon session reached 612.7 billion VND, the highest in the VN30 basket. VHM increased by 1.04% after reversing by 2.4%, VRE erased all the morning decrease to return to the reference.

The banking group was the focus supporting the market with a series of stocks increasing strongly: TCB increased by 3.01%, HDB increased by 1.59%, MBB increased by 1.51%, CTG increased by 1.34%, along with VCB, SHS and VND all traded positively. Liquidity of this group continued to be high, reflecting the active disbursement of domestic cash flow.

In the securities group, SSI increased by 0.94%, VND increased by 2.75%, SHS increased by 3.9%. Although VIX decreased slightly by 0.2%, the group still showed benefits from high liquidity and expectations that the market would enter a medium-term growth cycle.

The industrial and aviation sectors recorded a breakthrough, especially VJC with a strong increase of 6.87%, the most impressive increase among the large-cap group. PC1 increased by 6.91%, GEE increased by 5.84%, CII increased by 1.53%. These stocks benefited from the positive outlook of the aviation, energy and infrastructure sectors.

Although the real estate group did not explode, it recorded positive contributions from VIC, VHM, CEO, while some codes such as KDH, DIG, VPI and DXG traded less actively.

Total market trading liquidity reached VND22,696 billion, remaining at a high level with over 783 million shares traded. VN30 alone accounted for 62% of HoSE's trading value in the afternoon session, up 30.3% from the morning session.

A notable bright spot was the trading activities of foreign investors. Foreign investors returned to strong net buying of VND637.07 billion on all three exchanges, ending the previous long streak of net selling. The total buying value reached VND3,309.63 billion, selling VND2,672.55 billion. The codes with the strongest net buying were VIC (VND223.84 billion), TCB (VND130.98 billion), MBB (VND123.96 billion), VNM, FPT, MWG and SSI. On the contrary, foreign investors net soldACB , VIX, VPI, VRE, VCB and some other mid-cap codes.

Market breadth also improved significantly in the afternoon session. From 73 gainers/233 losers in the morning, HoSE closed with 144 gainers/149 losers; the number of stocks falling over 1% narrowed from 122 to 60. Notably, nearly 31% of stocks on HoSE had a reversal amplitude of 2% or more during the day; if calculated at 1%, this ratio is up to 58%.

The fact that the VN-Index surpassed 1,700 points and closed at 1,717.06 points shows that bottom-fishing demand is effective in the context of the market moving towards a strong resistance level around 1,800 points. However, the picture of differentiation still exists when the majority of stocks have not kept up with the index's growth.

Source: https://thoibaonganhang.vn/dong-tien-tro-lai-ngoan-muc-vn-index-dao-chieu-tang-1539-diem-174537.html

![[Photo] Cat Ba - Green island paradise](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F04%2F1764821844074_ndo_br_1-dcbthienduongxanh638-jpg.webp&w=3840&q=75)

![[Infographic] Cross-calculated exchange rates to determine taxable value from December 4-10](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/04/1764832340841_infographic-ty-gia-tinh-cheo-de-xac-dinh-tri-gia-tinh-thue-tu-4-1012-20251204120447.jpeg)

![[VIMC 40 days of lightning speed] Da Nang Port: Unity - Lightning speed - Breakthrough to the finish line](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/04/1764833540882_cdn_4-12-25.jpeg)

Comment (0)