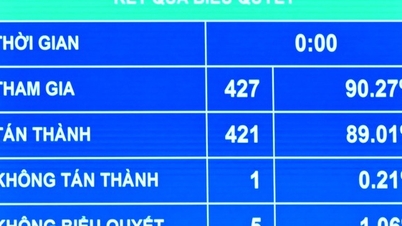

Reporting before the National Assembly's vote, Minister of Finance Nguyen Van Thang stated that the Government had incorporated the opinions of the National Assembly and the Standing Committee of the National Assembly to revise the regulations on personal deductions, ensuring compliance with the National Assembly's authority and alignment with practical realities. The personal deduction amount has been included in the draft law to ensure that the National Assembly has the authority to regulate fundamental tax matters.

Specifically, from 2026, the deduction for the taxpayer himself will be adjusted to 15.5 million VND/month. The deduction for each dependent will be adjusted to about 6.2 million VND/month.

"This amount is calculated based on fluctuations in the price index, per capita income, and the per capita GDP growth rate," Mr. Nguyen Van Thang explained. The draft law assigns the Government to submit to the Standing Committee of the National Assembly a proposal to adjust this personal allowance based on price and income fluctuations to suit the socio-economic situation in each period.

The Government has also taken into account the opinions of National Assembly deputies to revise the new tax schedule. Accordingly, the law has adjusted two tax rates: reducing the 15% tax rate (at level 2) to 10%; reducing the 25% tax rate (at level 3) to 20%.

With the new progressive tax schedule, all individuals currently paying taxes at all levels will have their tax obligations reduced compared to the current tax schedule, and the sudden increase at some levels has been overcome, ensuring more reasonableness.

The maximum tax rate, according to the newly passed law, remains at 35% (at bracket 5). The government argues that 35% is reasonable, representing an average tax rate compared to other countries in the region and around the world, aiming to ensure fair regulation and avoid being perceived as a "tax cut policy for the rich" if the rate were lowered.

According to the law, resident individuals engaged in production and business activities with annual revenue of 500 million VND or less are exempt from personal income tax. The Government is submitting to the Standing Committee of the National Assembly a proposal to adjust the revenue threshold for exemption from personal income tax to suit the socio-economic situation in each period. Individuals with annual revenue from over 500 million VND to 3 billion VND: tax rate 15%; from over 3 billion VND to 50 billion VND: tax rate 17%; over 50 billion VND: tax rate 20%.

The law also stipulates the taxation of gold bars, with a tax rate of 0.1% on the transfer price for each transaction, and assigns the Government the authority to regulate the tax threshold for gold bars, the time of application of taxation, and to adjust the personal income tax rate on gold bar transfers in accordance with the roadmap for managing the gold market.

Source: https://www.sggp.org.vn/ho-kinh-doanh-co-doanh-thu-duoi-500-trieu-dongnam-khong-phai-nop-thue-thu-nhap-ca-nhan-post827830.html

![[Photo] Explore the US Navy's USS Robert Smalls warship](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F10%2F1765341533272_11212121-8303-jpg.webp&w=3840&q=75)

![[Podcast] National Assembly approves personal allowance deduction of VND 15.5 million/month](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765340032834_hnm-1cdn-vn-thumbs-540x360-2025-11-04-_hnm-1cdn-vn-thumbs-540x360-2025-06-27-a7b22b8722-_thu.jpeg)

Comment (0)