In his opening speech, Head of Nghe An Provincial Tax Department Nguyen Bang Thang emphasized that organizing the workshop is one of the key tasks of Nghe An Tax Department, aiming at the strong and sustainable development of the business community in the province.

In the context of deep international integration, updating tax policies, global minimum tax and IFRS accounting standards is an urgent requirement, helping businesses improve their competitiveness and legal compliance.

.jpg)

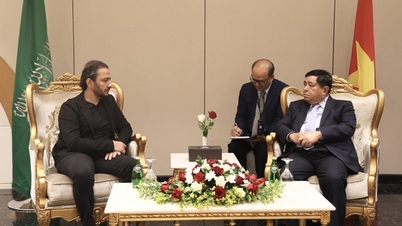

At the workshop, Head of EY Vietnam Tax Advisory Services Pham Manh Hung analyzed in depth the changes in tax policies in 2025 that have a direct impact on businesses. The focus areas include global minimum tax, electronic invoice management, and tax incentives for new investment businesses.

Mr. Hung emphasized that 2025 is a particularly important time with a series of amendments to tax and accounting policies. Some notable new points include: Resolution 204/2025/QH15 of the National Assembly reducing VAT from 10% to 8% for many groups of goods and services until December 31, 2026; Law on Value Added Tax, effective from July 1, 2025; Law on Corporate Income Tax, effective from October 1, 2025; Law on Tax Administration (amended), expected to be passed by the National Assembly in the ongoing Tenth Session. In particular, businesses need to pay attention to new regulations on invoices, including the application of electronic invoices from cash registers for business households and individual businesses.

The workshop also devoted significant time to updates on International Financial Reporting Standards (IFRS). Representatives from ACCA and EY Vietnam shared practical experiences in applying IFRS.

According to the roadmap of the Ministry of Finance , starting from 2025, IFRS will become a mandatory standard for listed enterprises, credit institutions and enterprises that need to mobilize capital in the international market. The application of IFRS is assessed to bring many practical benefits such as transparency of financial information, enhancing corporate reputation and increasing access to international capital sources.

.jpg)

At the workshop, experts also specifically answered many questions from businesses about the mechanism of VAT deduction and refund, handling of deductible expenses and difficulties in the process of applying IFRS.

Head of Nghe An Provincial Tax Department Nguyen Bang Thang affirmed that Nghe An Provincial Tax Department will continue to closely coordinate with organizations and businesses to build a transparent, modern and friendly tax environment. Updating policies and applying IFRS will contribute to the deep integration and sustainable development of businesses in the area.

Source: https://daibieunhandan.vn/nghe-an-cap-nhat-chinh-sach-thue-moi-va-chuan-muc-bao-cao-tai-chinh-quoc-te-ifrs-10393037.html

![[Photo] The 5th Patriotic Emulation Congress of the Central Inspection Commission](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761566862838_ndo_br_1-1858-jpg.webp)

![[Photo] Party Committees of Central Party agencies summarize the implementation of Resolution No. 18-NQ/TW and the direction of the Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761545645968_ndo_br_1-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man receives Chairman of the House of Representatives of Uzbekistan Nuriddin Ismoilov](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761542647910_bnd-2610-jpg.webp)

Comment (0)