A series of public companies have claimed they have found a perpetual “money printing machine” by using corporate cash to buy Bitcoin or other digital tokens and immediately their stock prices skyrocket, even more than the value of the tokens they bought.

Tokens in AI are the basic unit of text length, which can include punctuation and spaces and vary by language. The larger the number of tokens, the more comprehensive the output. Converting data such as text, images, audio clips, and video into tokens is called “tokenization.”

This is a “scenario” initiated by Michael Saylor. Saylor turned his company Strategy into a publicly traded Bitcoin holding vehicle. And throughout the first half of 2025, the strategy has been successful, with over a hundred different companies following Saylor’s path.

These companies, known as “digital asset treasuries” (DATs), have become one of the hottest trends in the public markets. Their shares have soared, attracting a host of big names from Paypal co-founder Peter Thiel to US President Donald Trump’s family.

One prominent example is SharpLink Gaming, whose stock price increased by more than 2,600% in just a few days after the company announced it would be shifting its business model from traditional gaming, selling shares to buy a large amount of Ethereum tokens.

However, it is difficult to explain why tokens become more valuable simply because they are held by a public company. And then the train starts to derail, slowly at first but then faster and faster.

In SharpLink’s case, the stock price has fallen 86% from its peak, making the entire company worth less than the digital tokens it owns. The company is now trading at about 0.9 times the value of its Ether holdings.

Another company, Greenlane Holdings, has seen its stock price fall more than 99% this year, despite holding about $48 million in BERA tokens. Alt5 Sigma, which is backed by the Trump family, has seen its stock price fall about 86% from its peak in June 2025.

Investors have realized that these holdings don't generate much yield other than just "sitting on a pile of money," and that's why their valuations have shrunk, said Fedor Shabalin, an analyst at B. Riley Securities.

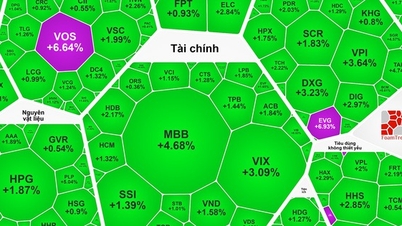

According to aggregated data, the average share price of DAT companies listed in the US and Canada has fallen 43% this year. Meanwhile, Bitcoin's price has only fallen about 6% since the beginning of the year.

The volatility of these stocks can be partly explained by the huge amount of borrowed money used to finance the cryptocurrency purchases.

Strategy has raised capital through a series of complex financial instruments such as convertible bonds and preferred shares to buy Bitcoin, at one point holding more than $70 billion in Bitcoin. According to Mr. Shabalin of B. Riley, the DAT group of companies has raised more than $45 billion this year to buy tokens.

Strategy and all other companies are now responsible for paying interest and dividends on those debts, a problem because the crypto assets they hold are largely cash-flow-free.

The biggest concern now is that DAT companies will be forced to sell their crypto assets, which will push the price of the tokens lower, starting a downward spiral.

DAT’s collapse threatened to spill over into broader markets as traders used leverage, forcing them to sell assets to meet margin calls. For now, the problems have all but halted the flow of new firms adopting the strategy and the boom in capital markets it once fueled.

There are signs that merger and acquisition (M&A) activity could be taking place, with more valuable DAT companies snapping up smaller ones that are valued below their assets.

Ross Carmel, a partner at Sichenzia Ross Ference Carmel, expects M&A activity in the DAT sector to pick up rapidly as early as 2026, with the aim of countering potential headwinds. Mr. Carmel said the industry is likely to see more structured securities transactions, “to provide investors with better downside protection mechanisms in these deals.”

Source: https://baotintuc.vn/thi-truong-tien-te/su-sup-do-cua-cac-kho-bac-tai-san-ky-thuat-so-20251208133326637.htm

![[Photo] Explore the US Navy's USS Robert Smalls warship](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F10%2F1765341533272_11212121-8303-jpg.webp&w=3840&q=75)

Comment (0)