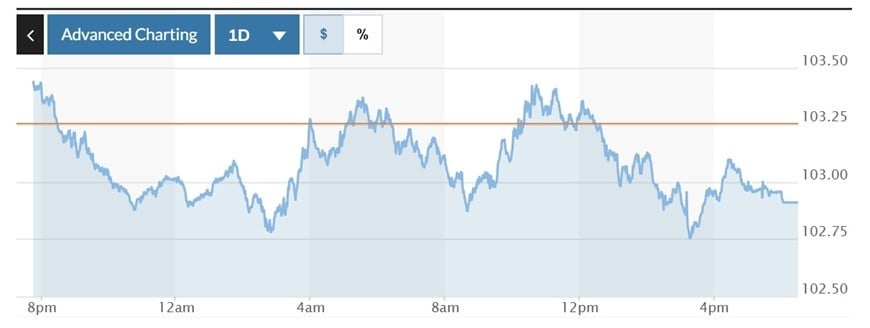

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.35% to 102.91.

USD exchange rate today in the world

The US dollar fell while the euro gained in the last trading session, as investors focused on trade disputes following US President Donald Trump's tariff policies.

The euro rose 0.52% to $1.0958 after falling in the previous two trading sessions, after the European Commission (EC) proposed imposing 25% retaliatory tariffs on a range of imported goods from the US. The move is seen as a direct response to tariffs imposed by President Donald Trump on EU steel and aluminum. The new tariffs will be applied in two stages. Some items will be taxed from May 16, while others will be taxed from December 1. The list of taxed items is diverse, including diamonds, eggs, dental floss, sausages, poultry, almonds and soybeans.

However, the Japanese yen and Swiss franc continued to benefit from safe-haven demand, as investors remained concerned about the possibility of a global recession.

Meanwhile, markets are bracing for a trade war between the US and China. US Trade Representative Jamieson Greer told US senators that the Trump administration will not back down on its trade strategy anytime soon.

China's yuan hit its lowest level since it began trading in 2010 at 7.3815 yuan per dollar. The currency closed down 1.05% against the greenback at 7.423 yuan per dollar.

The dollar fell 1% to 146.30 yen against the Japanese yen and fell 1.48% to 0.84780 franc against the Swiss franc.

The greenback has underperformed against other currencies, in part due to concerns about a recession in the face of tariffs, said Marvin Loh, senior global market strategist at State Street in Boston.

The DXY index fell 0.35% to 102.91.

The index has fallen about 0.7% since US President Donald Trump announced the tariffs on April 2, prompting investors to weigh the impact of the series of policies on the US economy.

The greenback's decline may be partly due to the recovery in stock markets in some parts of Asia, said Juan Perez, head of trading at Monex USA.

USD exchange rate in the country today

In the domestic market, at the beginning of the trading session on April 9, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD increased by 12 VND, currently at 23,898 VND.

* The reference exchange rate at the State Bank's buying and selling exchange center remains unchanged, currently at: 23,704 VND - 26,080 VND.

USD exchange rates at commercial banks for buying and selling are as follows:

USD exchange rate | Buy | Sell out |

25,750 VND | 26,140 VND | |

Vietinbank | 25,790 VND | 26,142 VND |

BIDV | 25,775 VND | 26,135 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center decreased slightly, currently at: 25,897 VND - 28,623 VND.

EUR exchange rates at commercial banks for buying and selling are as follows:

EUR exchange rate | Buy | Sell out |

Vietcombank | 27,697 VND | 29,215 VND |

Vietinbank | 27,967 VND | 29,167 VND |

BIDV | 27,928 VND | 29,177 VND |

* The Japanese Yen buying and selling rates at the State Bank's Exchange have slightly decreased, currently at: 160 VND - 177 VND.

Japanese Yen Exchange Rate | Buy | Sell out |

Vietcombank | 170.36 VND | 181.18 VND |

Vietinbank | 172.99 VND | 180.99 VND |

BIDV | 172.87 VND | 180.87 VND |

Source: https://baolangson.vn/ty-gia-usd-hom-nay-9-4-dong-usd-giam-dong-thai-ve-thue-quan-5043508.html

![[Photo] National Assembly Chairman Tran Thanh Man received a delegation of the Social Democratic Party of Germany](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761652150406_ndo_br_cover-3345-jpg.webp)

![[Photo] Flooding on the right side of the gate, entrance to Hue Citadel](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761660788143_ndo_br_gen-h-z7165069467254-74c71c36d0cb396744b678cec80552f0-2-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting to discuss solutions to overcome the consequences of floods in the central provinces.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/29/1761716305524_dsc-7735-jpg.webp)

![[Photo] President Luong Cuong attends the 80th Anniversary of the Traditional Day of the Armed Forces of Military Region 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761635584312_ndo_br_1-jpg.webp)

![[Photo] Draft documents of the 14th Party Congress reach people at the Commune Cultural Post Offices](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761642182616_du-thao-tai-tinh-hung-yen-4070-5235-jpg.webp)

Comment (0)