A number of securities companies have announced their Q2 2025 financial reports with high growth and huge profits, many times higher than the same period last year, but some companies have reported declining profits.

For example, BIDV Securities Company (stock code BSI) reported after-tax profit of VND 101.9 billion in the second quarter of 2025, a decrease of 11% compared to the same period last year, despite a 19% increase in operating revenue. However, financial expenses increased 2.2 times, along with management expenses and corporate income tax increasing by 21% and 16% respectively, causing the profit to decline. For the first six months of the year, BSI achieved after-tax profit of VND 183 billion, a decrease of 28% compared to the same period in 2024.

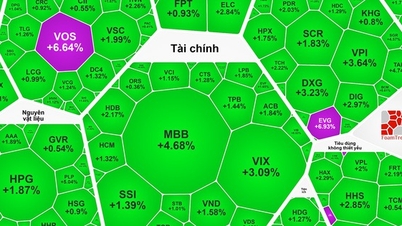

Despite the active trading market, many securities companies are still reporting declining profits.

PHOTO: DAO NGOC THACH

Similarly,FPT Securities Company (stock code FTS) recorded after-tax profit of VND 61 billion in Q2 2025, a decrease of 62% compared to the same period last year. The main reason was the revaluation of financial assets, especially the investment in MSH (May Song Hong) shares, resulting in a loss of VND 9.3 billion from proprietary trading activities this period. In addition, total expenses increased by 32% due to increased interest expenses. For the first six months of the year, FTS achieved revenue of VND 551 billion, a decrease of nearly 9%, and after-tax profit of nearly VND 214 billion, a decrease of 34.5% compared to the same period last year.

Ho Chi Minh City Securities Company (stock code HCM) also reported after-tax profit in Q2 2025 of VND 192.3 billion, a decrease of 39% compared to the same period last year, while operating revenue reached VND 1,073 billion, almost unchanged. Several factors contributed to the decline in profit, such as increased provisions for key assets while financial income decreased sharply. For the first six months of this year, HCM achieved after-tax profit of VND 419 billion, a decrease of VND 171 billion compared to the same period last year.

Another entity, KB Securities Vietnam (KBSV), also reported after-tax profit of VND 51 billion in the second quarter of 2025, a 20% decrease compared to the same period last year. According to the company, low market liquidity led to a decline in revenue from brokerage, HTM investment, and securities trading. In total, after the first six months of this year, the company achieved total revenue of nearly VND 438.4 billion and after-tax profit of VND 98.6 billion, both decreasing by nearly 34% compared to the same period last year...

Specifically, Dai Viet Securities (DVSC) and Apec Securities (stock code APS) reported losses in the second quarter of 2025, with after-tax losses of 2 billion VND and 7 billion VND respectively. This marks Apec Securities' third consecutive quarter of losses, bringing its cumulative losses to over 75 billion VND by the end of June...

Source: https://thanhnien.vn/vi-sao-nhieu-cong-ty-chung-khoan-bao-loi-nhuan-di-lui-18525072009284253.htm

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

Comment (0)