Total assets exceed half a million billion VND

As of June 30, 2025,VIB 's total assets reached more than VND 530,000 billion, up 8% compared to the beginning of the year. Outstanding credit balance exceeded VND 356,000 billion, up 10%, coming from even growth in the retail, SME, corporate and financial institutions sectors. In particular, the retail sector continues to be a bright spot with flexible, digitalized and customer-centric loan products. Notably, VIB launched a home loan package of VND 45,000 billion with the incentive of "borrow 1 billion, pay principal only VND 1 million/month in the first 5 years", helping young people easily access housing. The loan package has a fixed interest rate from 5.9%/year, super-fast approval thanks to AI and allows flexible repayment, free of prepayment fees. In the SME and corporate segment, VIB continues to selectively expand credit, focusing on supporting working capital flows and production and business needs of customers in the context of low interest rates.

Customer deposits grew steadily by 10%, reaching over VND304,000 billion. In particular, CASA and Super Yield accounts increased by 51% compared to the beginning of the year, showing the effectiveness of the strategy of optimizing idle cash flow.

Launched in early 2025, VIB's Super Yield account has attracted more than 500,000 activated customers, significantly expanding the high-quality potential customer base for banking products and services.

VIB's 2025 first half report also said that the bank's asset quality index continued to improve in the first half of the year. The bad debt ratio decreased to 2.54%, 0.14 percentage points lower than the end of the first quarter. VIB's loan portfolio maintained a high level of safety, with more than 75% of outstanding loans belonging to the retail and SME segments. In particular, group 2 debt continued to decline.

In the second quarter, VIB completed the payment of 7% cash dividends as approved at the 2025 General Meeting of Shareholders. Safety management indicators remained at an optimal level, in which the Basel II capital adequacy ratio (CAR) reached 12.0% (regulation: over 8%), the loan-to-deposit ratio (LDR) was at 77% (regulation: under 85%), the short-term capital ratio for medium and long-term loans was 23% (regulation: under 30%) and the Basel III net stable capital ratio (NSFR) was 111% (Basel III standard: over 100%).

6-month profit increased by 9%, promoting revenue diversification

At the end of the first 6 months of 2025, VIB recorded a total operating income of more than VND 9,700 billion, pre-tax profit of over VND 5,000 billion, up 9% over the same period. Net interest income reached more than VND 7,700 billion, continuing to be the main contributor in the context of the bank promoting retail credit with competitive interest rates, focusing on high-quality customers with good collateral.

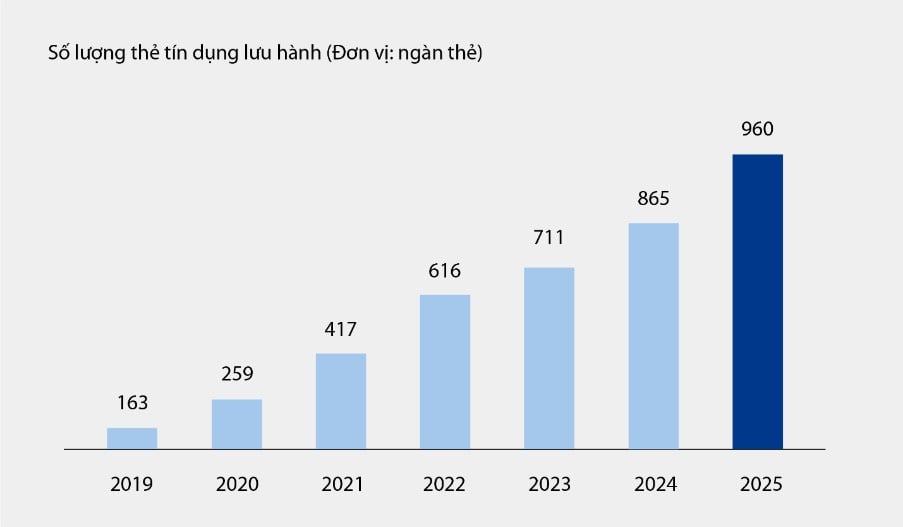

Non-interest income contributed positively, accounting for about 21% of total operating income, mainly from fees and service activities. As of June 30, 2025, VIB's credit cards reached nearly one million cards in circulation, with total spending after 6 months reaching more than VND 67,900 billion, up 15% over the same period. In addition, with new products and services deployed on the digital banking platform such as bill payment, international money transfer, tuition payment, insurance, etc., along with solution packages and services for corporate customers, they also contributed significantly to the bank's fee and service income.

Chart: Number of credit cards in circulation at VIB from 2019 - 6M2025

VIB's report also said that operating costs decreased by 1% year-on-year thanks to the synchronous implementation of process optimization solutions and effective cost management. At the same time, credit risk provisioning costs in the first 6 months of the year decreased by 49% year-on-year, thanks to the provisioning foundation that had been prudently set aside in previous quarters.

Perfecting the digital financial ecosystem, improving customer experience

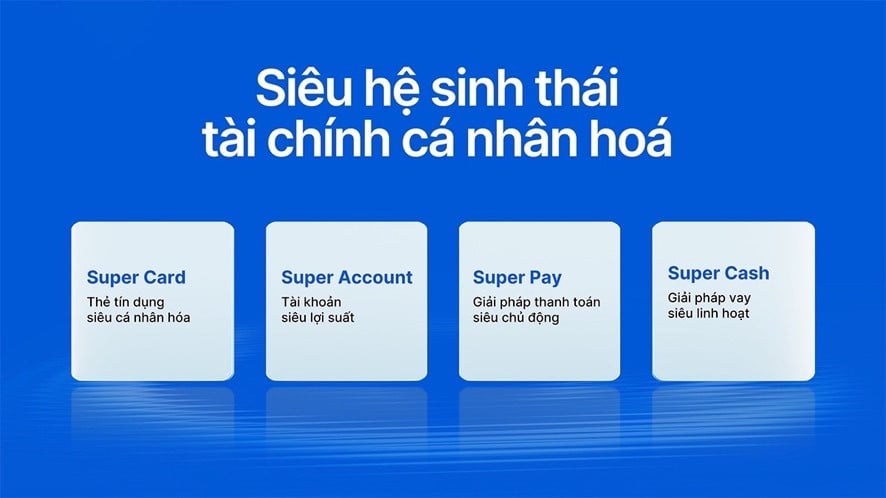

Continuing the strategy of pioneering technology and personalizing financial experiences, VIB recently launched two breakthrough products: Super Pay - a smart payment solution and Super Cash - a flexible loan solution. These are two important pieces that help VIB complete the super personalized financial ecosystem, empowering users to proactively manage their finances in a smart, safe and effective way.

The Super Pay solution supports customers in proactively managing their spending with three outstanding features: choosing a payment source (PayFlex), proactively registering for installment payments (PayEase), and proactively authenticating transactions (PaySafe) right on the MyVIB application. In addition, Super Cash provides a flexible capital access solution, allowing customers to transfer a credit limit of up to 1 billion VND between the card and a cash loan. The entire process takes place online on the Max by VIB application, with streamlined procedures, transparent interest rates, and no early settlement fees.

With a product suite including Super Pay, Super Cash, Super Account and Super Card, VIB is gradually realizing the goal of building a comprehensive digital financial ecosystem, giving users maximum financial control in the digital age.

“The bank’s business results in the first 6 months of 2025 confirm VIB’s correct orientation in improving operational efficiency, controlling risks and promoting digitalization. With a solid financial foundation, a quality credit portfolio and an increasingly complete digital ecosystem, VIB is ready to accelerate in the second half of the year, creating momentum for sustainable growth and optimizing value for customers, shareholders and the economy ,” said a VIB representative.

Bich Dao

Source: https://vietnamnet.vn/vib-loi-nhuan-6-thang-vuot-5-000-ty-dong-tang-truong-tin-dung-10-2426597.html

![[Photo] Ca Mau "struggling" to cope with the highest tide of the year, forecast to exceed alert level 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762235371445_ndo_br_trieu-cuong-2-6486-jpg.webp)

![[Photo] The road connecting Dong Nai with Ho Chi Minh City is still unfinished after 5 years of construction.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762241675985_ndo_br_dji-20251104104418-0635-d-resize-1295-jpg.webp)

![[Photo] Panorama of the Patriotic Emulation Congress of Nhan Dan Newspaper for the period 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762252775462_ndo_br_dhthiduayeuncbaond-6125-jpg.webp)

![[Photo] Ho Chi Minh City Youth Take Action for a Cleaner Environment](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762233574890_550816358-1108586934787014-6430522970717297480-n-1-jpg.webp)

Comment (0)