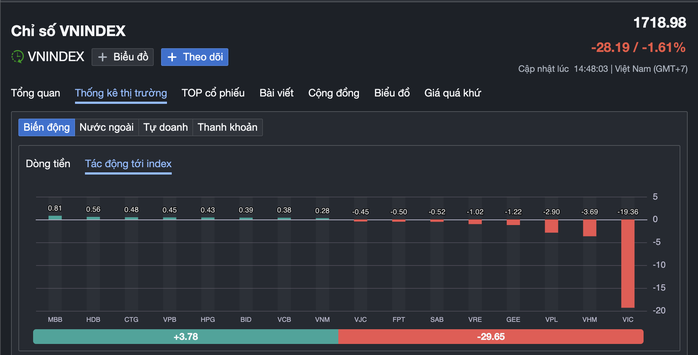

Opening near the reference level of 1,749.20 points, the index quickly came under heavy selling pressure and plummeted. At the close of the session, the VN-Index fell 28.19 points (equivalent to a 1.61% decrease), retreating to 1,718.98 points. During the session, the index briefly touched a low of 1,712.93 points. The market saw 188 declining stocks, 121 rising stocks, and 62 unchanged stocks.

The main factor driving this record-breaking decline was the overwhelming selling pressure on blue-chip stocks, especially those within the Vingroup ecosystem. VIC (Vingroup Group) shares experienced the most negative impact, facing intense selling pressure early on and closing at the floor price of 148,800 VND/share, losing 7% of their value. VIC alone contributed to a 19.36-point drop in the overall index. Notably, this was a rare decline for this stock after dozens of previous strong price increases.

The selling pressure spread to other stocks in the ecosystem. VHM (Vinhomes) fell sharply, contributing 3.69 points to the overall index decline. VRE (Vincom Retail) also dropped sharply by 6.8% to its floor price, ranking among the top 5 stocks with the most negative impact, subtracting an additional 1.02 points from the index.

VIC shares fell sharply, negatively impacting the entire market.

Statistics show that the group of three stocks, VIC, VHM, and VRE, alone accounted for a total loss of over 24 points from the VN-Index. While the entire market fell by 28.19 points, the Vingroup group contributed over 85% of this decline. If the fluctuations of this group were excluded, the market would actually only have recorded a normal correction of about 4 points. However, the decline of the largest capitalized stocks in the market caused a widespread panic sell, leading to a flight of capital from other sectors.

Furthermore, the market outlook was further gloomy due to the lackluster performance of foreign investors. Data shows that foreign investors continued to heavily net sell, with a value of VND 367.75 billion (total sales of VND 2,226 billion, total purchases of VND 1,859 billion). This decisive "sell-off" by foreign investors, coupled with the negative sentiment of domestic investors, widened the decline in the index.

The only bright spot in the session came from the banking sector, with MBB, BID, VPB, and CTG acting as support. MBB and BID maintained their positive performance, contributing 0.81 and 0.39 points respectively to the VN-Index. However, this support was insufficient to offset the widespread downward pressure. Technology, real estate, essential consumer goods, and the steel sector all experienced significant declines.

Source: https://nld.com.vn/vn-index-giam-sau-hon-28-diem-196251210152613827.htm

![[Photo] The captivating scenery of the fragrant maple forest in Quang Tri](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F10%2F1765353233198_lan09046-jpg.webp&w=3840&q=75)

![[Photo] Explore the US Navy's USS Robert Smalls warship](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F10%2F1765341533272_11212121-8303-jpg.webp&w=3840&q=75)

![[Video] The craft of making Dong Ho folk paintings has been inscribed by UNESCO on the List of Crafts in Need of Urgent Safeguarding.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765350246533_tranh-dong-ho-734-jpg.webp)

Comment (0)