Although the VN-Index remained below the reference level throughout this morning's session, experiencing its sharpest decline of over 20 points towards the end of the morning, the index still managed to maintain its position above the 1,700-point mark.

However, the selling pressure was so strong in the afternoon session, spreading to all sectors and most stocks on the exchange, that after 2 PM, the VN-Index officially broke through the 1,700-point mark, and the index fell even more sharply towards the end of the session.

At the close of trading, the VN-Index fell 94.76 points, or 5.47%. The index retreated to close at 1,636.43 points. In terms of points, today's session recorded the largest decline ever.

|

| VN-Index movement. |

Instead of just a few stocks driving the price up, today's market saw pressure concentrated across all sectors, from large-cap to mid-cap and small-cap stocks.

Today, the VN30 index showed only a slight gain from VJC, but by the end of the day, no stocks in the basket had risen. In fact, 13 stocks hit their lower limit, and excluding VJC, the remaining 29 stocks all fell by more than 1%, with 24 of them dropping by more than 4%. Today's session saw the VN30 index fall by over 106 points, equivalent to a 5.38% decrease, closing at 1,870.86 points.

The VNMID group of mid-cap stocks also fell by 6.19%, while small-cap stocks saw a more moderate decline (-4.41%).

In summary, on the HoSE, by the end of the day, only 34 stocks were still in the green, while 325 stocks lost points, with 108 hitting the floor price.

With this sharp decline, the market is no longer focusing on which sector experienced the biggest drop, as almost all sectors' stocks were affected. Notably, the index failed to maintain the 1,700-point mark, having just recently surpassed this historical threshold on October 9th.

On online forums, investors expressed surprise at today's trading session, given the absence of significant negative news that could have a major impact on the market. However, the possibility of further correction had been anticipated, and market sentiment, after the sharp correction last weekend, was also affected, leading to stronger selling pressure.

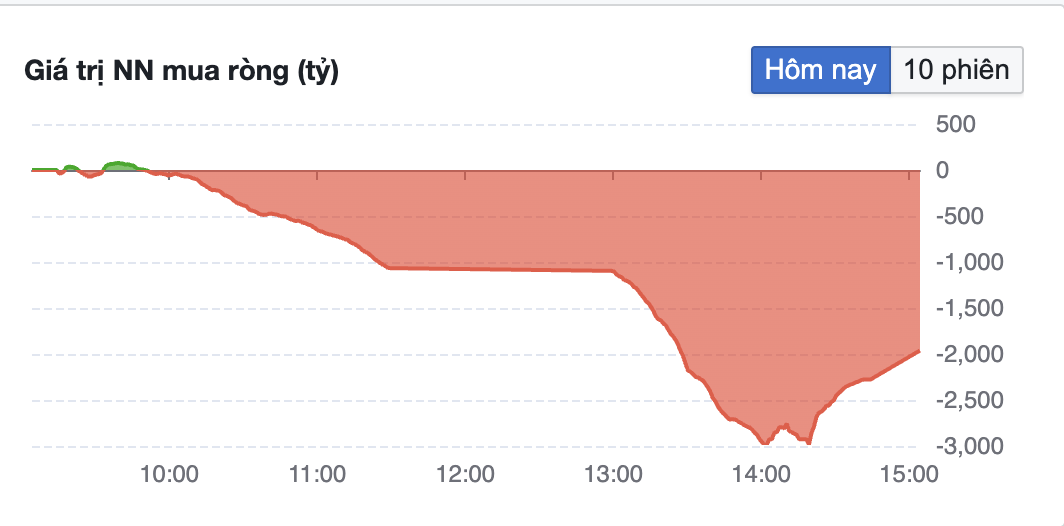

Notably, foreign investors narrowed their selling pressure during the trading session. While the net selling value of foreign investors reached nearly 3 trillion VND by 2 PM, shortly afterward, as the VN-Index continuously weakened and selling pressure intensified, some foreign capital returned to buying shares, indicating a "bottom-fishing" signal.

|

| Foreign investors showed signs of buying stocks at the bottom during the latter half of the afternoon trading session on October 20th. |

This resulted in the total net selling value of this group today being only 1,962 billion VND, which, although still very large, remains at a level equivalent to the closing price of last week's session. In fact, the buying value was even higher, reaching over 4,566 billion VND, while the buying power in the previous session was only 3,766 billion VND.

While foreign investors bought 4,566 billion VND and sold 6,528 billion VND on the HoSE today, in the VN30 index alone, they sold over 4,505 billion VND while buying 2,900 billion VND. The largest selling volume came from MSN shares, with foreign investors net selling over 655 billion VND.

Today, the trading value on HoSE increased sharply compared to the previous three sessions, reaching over 53,200 billion VND. Meanwhile, the trading value in VN30 accounted for over 30,551 billion VND.

In a commentary this morning, Mr. Nguyen The Minh , Director of Retail Client Analysis at Yuanta Securities Vietnam, shared his views on the market's relative valuations following last weekend's correction.

|

| The relative valuation levels for the period 2014-2025 indicate that the VN30 index remains in the undervalued zone. Source: Yuanta |

Accordingly, as of now, the VN30 and VN100 stock groups remain undervalued despite these indices continuously setting record highs recently. This is also the main reason why capital flows are still primarily concentrated in large-cap stocks.

Source: https://baodautu.vn/chung-khoan-phien-2010-vn-index-khong-giu-duoc-moc-1700-diem-dinh-gia-vn30-van-con-qua-hap-dan-d416885.html

Comment (0)