Take decisive action to prevent money laundering and terrorist financing.

In early 2024, Agribank 's Anti-Money Laundering Center, with a team of 26 dedicated officers, officially commenced operations. Along with the establishment of the Center and in strict adherence to Vietnam's Anti-Money Laundering Law, Agribank has issued rigorous internal procedures and organized in-depth training courses on identifying money laundering and terrorist financing risks for all staff, especially frontline tellers, in order to build a "culture of compliance" throughout the system.

Subsequently, a series of important operational activities were organized, such as: sending representatives to participate in the Training Program on Combating the Financing of Weapons of Mass Destruction in March 2024; successfully organizing 16 training courses on anti-money laundering and counter-terrorism financing in May and June 2024; organizing advanced training to enhance in-depth knowledge on anti-money laundering, counter-terrorism financing, and financing of weapons of mass destruction... These activities quickly raised awareness and professional skills in identifying and handling issues related to anti-money laundering and illegal lending for officers and employees throughout the system.

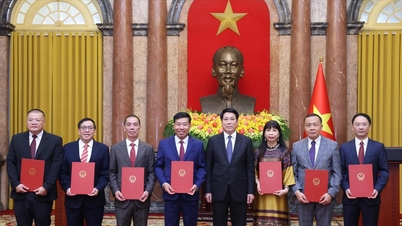

Agribank improves people's access to capital, contributing to preventing illegal lending. Photo: Agribank

In particular, given the complex nature of loan sharking, sophisticated money laundering, and terrorist financing activities, which pose significant risks to the financial and banking sector, on October 13, 2025, Agribank General Director Pham Toan Vuong issued Document No. 15030/NHNo-PCRT to proactively prevent illegal activities related to "loan sharking" and money laundering. Accordingly, the General Director requested heads of units within the system to strictly implement legal regulations on money laundering prevention; measures to prevent the buying, selling, leasing, and lending of bank accounts, and the misuse of e-wallets and intermediary payment services for illegal purposes; and to strengthen internal communication within the system and to customers regarding legitimate credit mechanisms and policies, and to warn of risks from "loan sharking" activities. Enhance knowledge in detecting anomalies in large and suspicious transactions; strengthen supervision and inspection, deploy technology and digital transformation to prevent and detect suspicious activities and transactions with signs of risk early and remotely; resolutely refuse to abet or condone gambling, usury, fraud, and illegal lending activities.

Proactively prevent predatory lending.

Besides the risks from money laundering and terrorist financing, illegal lending is also becoming a major challenge, infiltrating daily life and causing instability in security and order, disrupting the sound credit structure. More worryingly, these perpetrators often target rural areas – Agribank's core customer group.

With the advantage of possessing the largest transaction network nationwide, covering even remote and rural areas, Agribank bears a dual responsibility: serving as both the primary channel for capital flow and a "shield" protecting millions of farmers from the vicious cycle of illegal lending. For many years, to proactively prevent "black market lending," Agribank has implemented the most fundamental solution: providing official capital to farmers promptly, conveniently, and at the most reasonable cost. Agribank considers providing capital support to farmers not only a business activity but also a social responsibility.

Accordingly, the bank increased the frequency of organizing mobile transaction points using specialized vehicles, bringing financial services to villages and hamlets. Along with close coordination with the Farmers' Association, Women's Association, and other local political and social organizations, Agribank has carried out the work of appraising and disbursing capital to the right recipients, creating a solid social security network.

With decisive and coordinated solutions, from proactively supporting people with official capital sources to tightening discipline and compliance with international standards, Agribank is building a safe and transparent financial system, protecting the legitimate rights of customers and contributing to the overall stability of the economy .

Source: https://daibieunhandan.vn/trung-tam-phong-chong-rua-tien-agribank-la-chan-kep-bao-ve-ngan-hang-va-nguoi-dan-10400330.html

![[Image] Close-up of the newly discovered "sacred road" at My Son Sanctuary](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F13%2F1765587881240_ndo_br_ms5-jpg.webp&w=3840&q=75)

Comment (0)