On October 26th, the State Bank of Vietnam (SBV) Region 2 announced that, as of the end of October, the total outstanding credit balance of credit institutions in Ho Chi Minh City was estimated at over 4.9 million billion VND, an increase of nearly 9.8% compared to the same period in 2024.

Accordingly, outstanding loans in VND are estimated at over 4.7 million billion VND, accounting for 96% of the total, an increase of nearly 10.3% compared to the end of the previous year. Outstanding loans in foreign currency are estimated at over 195,300 billion VND, accounting for 4% of the total, a decrease of nearly 1% compared to the end of last year.

Of the total outstanding debt of over 4.9 million billion VND, more than 2.3 million billion VND is short-term credit, accounting for nearly 48%, and nearly 2.6 million billion VND is medium and long-term credit, accounting for over 52%.

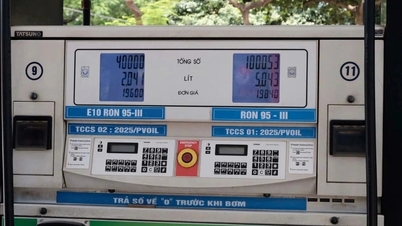

Outstanding credit in Ho Chi Minh City reached over 4.9 million billion VND. (Photo: BL)

According to a representative from the State Bank of Vietnam, outstanding credit in Ho Chi Minh City maintained growth in the first few months of the year, increasing by 7.33% compared to the end of 2024. Short-term and medium- to long-term credit both showed positive growth compared to the end of the year. Credit denominated in VND accounted for the majority.

“It is projected that by October 31, 2025, outstanding credit in Ho Chi Minh City will continue to grow, increasing by 9.79% compared to the end of 2024. All credit segments by maturity will maintain growth. The banking sector in Ho Chi Minh City will continue to provide credit capital for production and business, actively participating in solutions to support businesses and promote economic growth in the area,” a representative from the State Bank of Vietnam shared.

According to the State Bank of Vietnam, many credit programs in Ho Chi Minh City are also being actively implemented.

Specifically, as of October 31st, outstanding credit for agricultural and rural development is estimated at VND 440,000 billion; export loans at VND 144,000 billion; loans for supporting industries at over VND 102,000 billion; and loans for high-tech enterprises at VND 5,300 billion. Outstanding credit for small and medium-sized enterprises reached over VND 2.2 million billion.

As of the end of October, the banking sector had disbursed more than 32,500 billion VND from the 150,000 billion VND credit package supporting agricultural and forestry product manufacturing and processing businesses in Ho Chi Minh City.

The agricultural and rural lending program under Government Decrees 116/2018 and 55/2015 also has outstanding loans in Ho Chi Minh City reaching over 467,000 billion VND with more than 1.75 million customers, a decrease of 1.35% compared to 2024.

Source: https://vtcnews.vn/du-no-tin-dung-tai-tp-hcm-dat-hon-4-9-trieu-ty-dong-ar983266.html

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[Infographic] Cross-exchange rates for determining taxable value from December 11-17](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765413245543_infographic-ty-gia-tinh-cheo-de-xac-dinh-tri-gia-tinh-thue-tu-11-1712-20251211021920.jpeg)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)