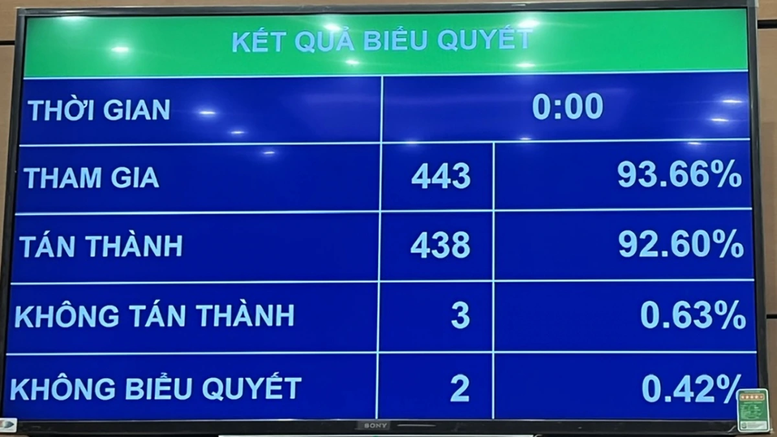

Voting results on the Law on Personal Income Tax (amended)

On the morning of December 10th, the National Assembly passed the amended Personal Income Tax Law and several amendments to the Tax Administration Law. Accordingly, the revenue threshold for household and individual businesses exempt from tax has been raised from 200 million VND/year to 500 million VND/year.

This is seen as a significant reform aimed at reducing the burden of procedures and compliance costs for the individual economic sector, while also aligning with the context of business recovery and the adjustment of the general price level.

According to the new regulations, households and individual businesses with total revenue not exceeding 500 million VND in the fiscal year will not have to pay personal income tax or value-added tax.

Raising the tax-exempt revenue threshold to a new level is expected to provide additional incentive for small businesses to accumulate capital, expand their operations, and formalize their business models.

For household and individual businesses with annual revenue ranging from over 500 million VND to 3 billion VND, the law allows taxpayers to choose their preferred tax calculation method.

There are two main methods of calculation: One is based on actual income, i.e., revenue minus reasonable expenses, with the taxable income subject to a 15% tax rate. The second is based on a percentage of revenue, where only the portion of revenue exceeding 500 million VND is included in the tax calculation.

This flexibility is to ensure greater fairness, accurately reflecting the capacity and business reality of each household.

The amended law also retains the current personal allowance rates: VND 15.5 million per month for the taxpayer themselves and VND 6.2 million per month for each dependent.

This helps to better protect low-income workers or those with multiple family responsibilities, while maintaining policy stability during the transition period.

New regulations create room for grassroots economic development

Statistics show that Vietnam currently has more than 2.54 million business households, of which about 90% have a revenue of less than 500 million VND per year.

This means that the majority of business households nationwide will be exempt from taxes under the new adjusted rates. Not only will this reduce financial pressure, but the policy is also expected to encourage business households to transform, expand their scale, and operate more transparently, contributing positively to overall economic growth.

This adjustment to the taxable revenue threshold reflects a trend towards tax reform that is modern, fair, and in line with market realities.

The new policy not only facilitates the household economic sector but also contributes to expanding the tax base in a sustainable manner, fostering long-term revenue sources for the State budget in the future.

Phuong Lien

Source: https://baochinhphu.vn/thong-qua-luat-thue-thu-nhap-ca-nhan-sua-doi-ho-kinh-doanh-thu-duoi-500-trieu-dong-nam-duoc-mien-thue-10225121011144591.htm

![[Video] The craft of making Dong Ho folk paintings has been inscribed by UNESCO on the List of Crafts in Need of Urgent Safeguarding.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765350246533_tranh-dong-ho-734-jpg.webp)

Comment (0)