In 2023, the audited after-tax profit of Cen Land – a company where Mr. Pham Thanh Hung (Shark Hung) serves as vice chairman – was just over 2 billion VND. This profit figure also decreased by more than 466 million VND compared to the after-tax profit reported in the previously prepared financial statements.

In the same period last year, Cen Land's after-tax profit reached over 194 billion VND.

According to Cen Land, in 2023, the real estate market faced many difficulties and unfavorable factors such as banks tightening credit for real estate transactions, and capital raising channels through bonds being controlled, putting great pressure on homebuyers and investors. Net revenue and profits both decreased significantly compared to the same period of the previous year.

In its separate financial report, Cen Land also explained that the investor of the new urban area project Hoang Van Thu (Louis Hoang Mai) has not fully paid the land use fee for phase 3. The progress of implementing the business cooperation contract for this project may be slower than expected.

Currently, the investor has paid 758.7 billion VND in land use fees, the remaining debt is 668.1 billion VND. Due to the large amount of land use fees, combined with the difficult economic situation, sales have been affected, so the expected revenue to pay land use fees has not been as planned.

Regarding the Hoa Tien Paradise project, Cen Land also explained that its partner, Hong Lam Xuan Thanh JSC, has not yet paid the full amount of value-added tax, corporate income tax, and late payment penalties to the State budget.

The tax debt of Hong Lam Xuan Thanh Joint Stock Company is affecting the auditor's opinion on determining the recoverability of accounts receivable.

Cen Land has worked with the investor to propose tax payment. The total tax debt and late payment penalties of Hong Lam Xuan Thanh JSC are estimated at approximately 70 billion VND.

As of December 31, 2023, Cen Land's total assets decreased by 6.8% compared to the beginning of the year, equivalent to a decrease of VND 515.8 billion, to VND 7,101.3 billion. Of this, the main assets were short-term receivables at VND 4,110.7 billion, accounting for 57.9% of total assets; long-term receivables at VND 1,750.3 billion, accounting for 24.6% of total assets; cash and short-term financial investments at VND 275.9 billion, accounting for 3.9% of total assets; and other items.

At the close of trading on April 1st, CRE shares reached 9,400 VND/share.

Source

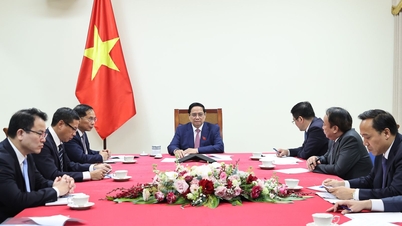

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)