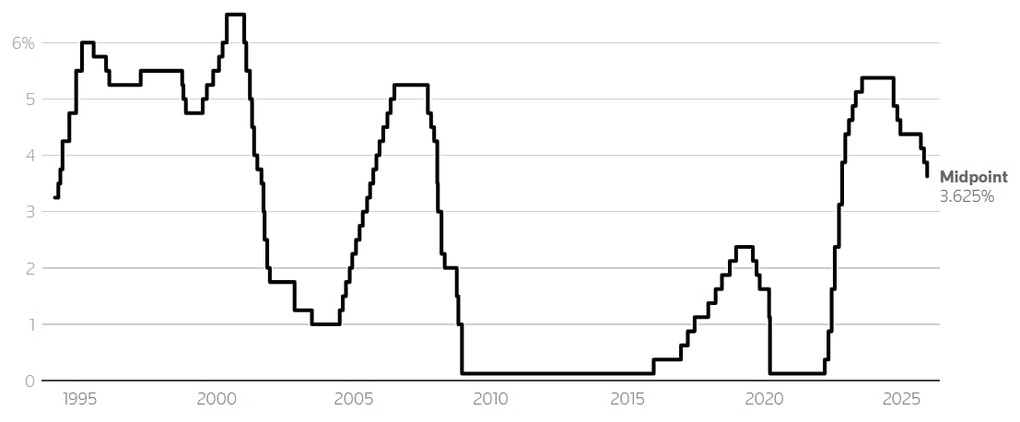

Following a two-day policy meeting, the Federal Open Market Committee (FOMC) lowered the overnight interest rate by another 0.25%, to a range of 3.5-3.75%, according to CNBC.

In a statement following the meeting, the FOMC said that regarding the extent and timing of further adjustments to the federal funds rate target, the Committee would need to carefully assess factors such as new economic data, the changing economic outlook, and the risk balance.

Fed Chairman Jerome Powell said the new rate cut puts the Fed in a more "breathable" position. "We are in a good position to watch how the economy develops, but the next decisions for January have not yet been made," he said.

The agency assessed the outlook as increasingly uncertain, with inflation having accelerated since the beginning of the year and remaining at high levels. The Fed expects to cut interest rates only once a year for the next two years, by 25 basis points.

The Fed's interest rate movements (Photo: Reuters).

The Fed's forecasts this week were heavily influenced by the 43-day US government shutdown from October to November.

The most recent official economic reports on the labor market and inflation only have data up to September, forcing policymakers to rely on private estimates, internal surveys, and discussions with businesses and the community.

Jerome Powell's term as Fed Chairman will end in May 2026. President Trump has announced he will nominate a successor early next year, followed by a confirmation process in the Senate.

US President Donald Trump wants cheaper borrowing costs to boost the housing market. However, giving in to that desire would pose risks for the next Fed chairman, given that many forecasts suggest economic growth in 2026 will remain fairly robust as consumer spending is supported by large tax rebates, leading to more persistent inflation.

"Regardless of who leads the Fed, economic conditions will ultimately determine monetary policy," said James Engelhof, chief US economist at BNP Paribas, during a press briefing on the 2026 outlook.

He predicted that growth and inflation of around 3% would only allow for one interest rate cut next year, following this week's rate reduction. "The data will not support a path of aggressive easing," Engelhof stated.

That could put the next Fed chairman in a similar position to Jerome Powell, facing pressure from Trump to lower interest rates while the economy needs tightening rather than stimulus.

Source: https://dantri.com.vn/kinh-doanh/fed-ha-lai-suat-025-dua-nhieu-tin-hieu-canh-bao-quan-important-20251211002345973.htm

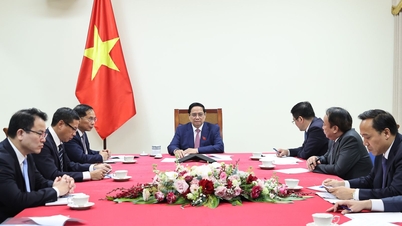

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)