Investors reacted positively to news that the US government is looking to buy oil to replenish its strategic reserves.

At the close of trading on the Singapore electronic exchange, North Sea Brent crude for November 2025 delivery rose $1.24, or 2%, to $62.56 per barrel. West Texas Intermediate (WTI) crude rose $1.20, or 2.1%, to $58.44 per barrel.

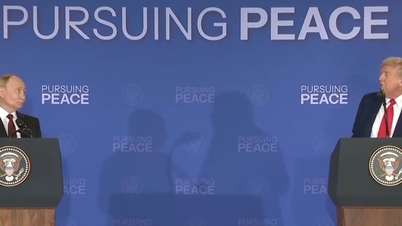

Oil prices fell to a five-month low earlier in the week as surging supplies and trade tensions darkened the demand outlook. However, supply concerns were heightened after a summit between US President Donald Trump and Russian President Vladimir Putin was postponed, as Western countries increased pressure on Asian countries to limit purchases of Russian oil.

“Although market sentiment remains negative due to abundant supply and weak demand, the risk of disruptions in hotspots such as Russia, Venezuela, Colombia and the Middle East remains, thereby helping oil prices not fall below $60/barrel,” said Mukesh Sahdev, CEO of energy consultancy XAnalysts.

Today's gains were also supported by buying to cover short positions after previous sharp corrections in many markets such as cryptocurrencies, regional bank stocks and gold and silver, according to Tony Sycamore, an analyst at IG Australia.

Investors are also closely monitoring tensions between the U.S. and Venezuela – a key oil producer – and the progress of U.S.-China trade talks, as officials from both countries are expected to meet in Malaysia this week.

Mr Trump stressed his hope of reaching a “fair” deal with Chinese President Xi Jinping at a planned meeting in South Korea next week, but then left open the possibility that the meeting “may not happen”.

The US Department of Energy said on October 21 that it will buy 1 million barrels of crude oil for the Strategic Petroleum Reserve (SPR), taking advantage of relatively low oil prices to replenish national reserves.

Source: https://baotintuc.vn/thi-truong-tien-te/gia-dau-tang-phien-thu-hai-lien-tiep-20251022153834444.htm

![[Video] The craft of making Dong Ho folk paintings has been inscribed by UNESCO on the List of Crafts in Need of Urgent Safeguarding.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765350246533_tranh-dong-ho-734-jpg.webp)

Comment (0)