The US and European countries consider chip production a strategic priority. Many new chip factories are being built in the US, Europe and Asia. According to the Semiconductor Industry Association (SIA), nearly $1,000 billion is expected to be invested in this field by 2030.

The global semiconductor market is growing at an average rate of 6-8% (CAGR). Along with the development of the industry, the demand for semiconductor labor is always high.

According to data analytics firm McKinsey & Company, the number of job postings for semiconductor engineering positions has skyrocketed, at a rate of more than 75% from 2018 to 2022. However, paradoxically, semiconductor human resources are in short supply globally, even in developed countries and large technology corporations.

The US Bureau of Labor Statistics estimates that the country will face a shortage of 300,000 engineers and 90,000 skilled semiconductor technicians by 2030.

During a recent visit to Vietnam, SIA President and CEO John Neuffer expressed concern about this issue, saying that if not supplemented, by 2030, the US will fall into a serious shortage of human resources in the semiconductor industry.

According to McKinsey & Company, the semiconductor industry is facing an age gap. One-third of semiconductor workers in the US are 55 or older, meaning they are close to retirement. In Europe, one-fifth of the semiconductor workforce is in this age group.

Figures from the German Association of Electrical and Digital Industries (ZVEI) and the Federation of German Industries (BDI) show that about one-third of those working in the country's semiconductor industry will retire in the next decade.

In addition to an aging workforce, the global semiconductor industry faces other problems. First is the challenge of building a brand to attract technology talent.

McKinsey & Company points out that surveys of both employers and college students show a lack of public enthusiasm for semiconductor brands.

About 60% of senior executives believe that semiconductor companies have weak brand image and recognition compared to other technology companies.

Meanwhile, students are more interested in job opportunities at consumer-facing technology companies. They believe that jobs at other technology companies are more interesting, pay higher salaries and have better growth prospects than the semiconductor industry.

Not only that, according to the Great Attrition/Great Attraction survey conducted by McKinsey & Company in March 2023, more and more workers in the electronics and semiconductor fields are likely to leave their current jobs within the next 3 to 6 months.

The proportion of semiconductor workers planning to leave their jobs is 53% by 2023, up from 40% in 2021. When asked, these people said that the reason for this decision was because they could not develop and advance their careers (34%), another reason was the lack of flexibility in the workplace (33%).

This trend is worsened by the fact that people who intend to quit are not only leaving the company they are working in, but they are also leaving the industry they are pursuing.

In Australia, India, Singapore, the UK and the US, only 36% of semiconductor workers quit and took a new job in the same industry between April 2020 and April 2022. The remaining 64% of those who quit chose to move to another industry or retire and leave the labor market.

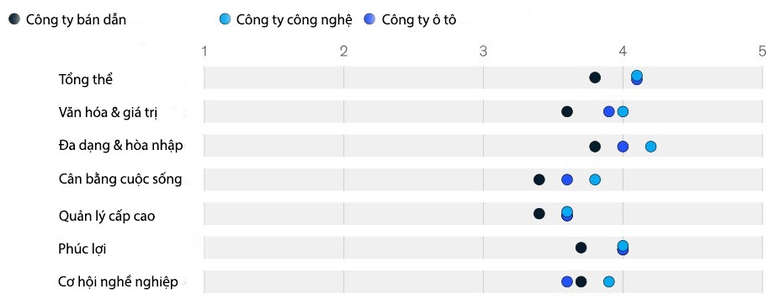

Not stopping there, psychological issues are also a barrier that makes workers leave the semiconductor industry. Data from recruitment network Glassdoor shows that, compared to automakers and the "Big Tech" group, semiconductor companies are not highly appreciated by employees for the balance between work and personal life. Welfare factors and corporate culture of semiconductor companies are also inferior.

The above reasons are the reason why the global semiconductor workforce is scarce. Despite the huge demand for semiconductors, the industry is struggling with a serious crisis in human resources.

Opportunity to "export semiconductor human resources" for Vietnam?

Speaking to VietNamNet , Prof. Dr. Tran Xuan Tu, Director of the Institute of Information Technology (Hanoi National University) said that the world is currently lacking semiconductor human resources, both in manufacturing and design. Working in shifts, harsh working environments; the lack of STEM graduates to supplement and replace will create a large gap in the labor market. In that context, along with India, Vietnam is considered a country with the potential to export technical workers.

According to the National Innovation Center (NIC, Ministry of Planning and Investment), Vietnam has an abundant workforce in related engineering and technology fields. This is the potential and opportunity to develop the semiconductor industry ecosystem.

Professor Tran Xuan Tu said that compared to other IT fields, the semiconductor industry has some unique characteristics. If doing software, students only need to care about the software and the underlying hardware. However, when doing hardware, they must clearly understand how the hardware works.

Design is now largely automated, using hardware description languages (essentially software) to describe the design. Semiconductors must also have skills in software programming, data structures and algorithms, etc.

“ In addition to hardware and software knowledge, semiconductor workers must also have knowledge of applications. Another problem is that they must integrate a lot of different knowledge to solve practical problems. This is a difficulty for hardware designers and microchip designers ,” explained the Director of the Institute of Information Technology.

After training, students must meet certain conditions to be able to participate in the semiconductor labor market; such as: skills, qualifications; English and cultural adaptation.

This expert believes that Vietnam may have a big advantage in terms of labor resources, combined with the passion for technology among young people. However, if we train semiconductor workers en masse, we will still have difficulty finding a market.

In that context, Vietnam needs to actively attract FDI enterprises to solve the output problem when promoting human resource training in the semiconductor industry. On the other hand, it should also consider training and fostering high-quality semiconductor human resources capable of working in a global environment.

Source

![[Photo] Prime Minister Pham Minh Chinh attends the annual Vietnam Business Forum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/10/1762780307172_dsc-1710-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh attends the Patriotic Emulation Congress of the Ministry of Foreign Affairs for the 2025-2030 period](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/10/1762762603245_dsc-1428-jpg.webp)

![Dong Nai OCOP transition: [Article 3] Linking tourism with OCOP product consumption](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/10/1762739199309_1324-2740-7_n-162543_981.jpeg)

Comment (0)