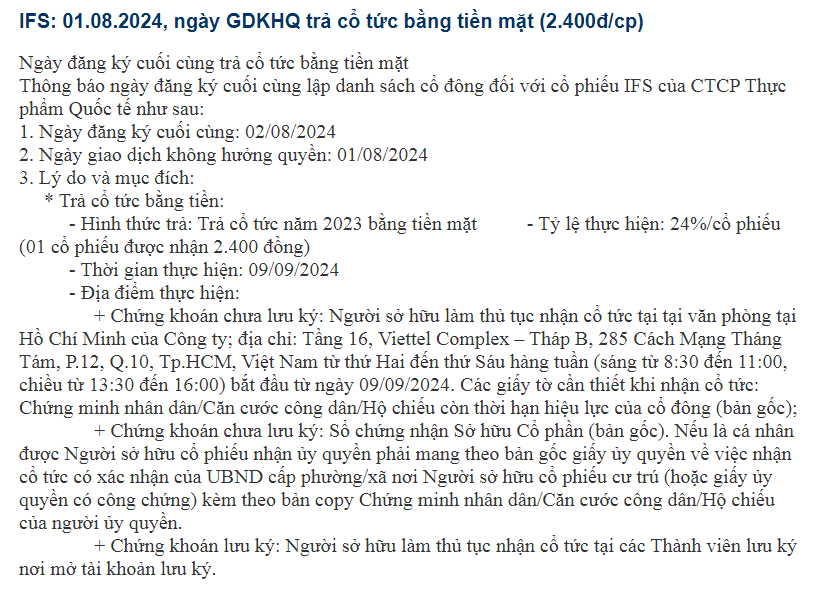

Owner of winter melon tea brand Wonderfarm pays highest cash dividend at 24% rate

Interfood Joint Stock Company (Interfood - Code: IFS) set August 2 as the last registration date to receive 2023 cash dividends at a rate of 24% (1 share receives VND 2,400). Corresponding to the ex-dividend date of August 1, the payment date is September 9.

With more than 87 million shares in circulation, Interfood needs to spend nearly VND209 billion to pay dividends. This is the highest dividend ever paid by the owner of the Wonderfarm winter melon tea brand.

This 209 billion VND is the entire undistributed profit after tax of Interfood as of December 31, 2023.

Previously, Interfood had used almost all of its retained earnings to pay cash dividends to shareholders for two consecutive years.

Specifically, in 2021, the company spent 16.6 billion VND to pay dividends at a rate of 1.9%. A year later, the company continued to spend nearly 155 billion VND to pay dividends at a rate of 17.8%.

International Food - Owner of winter melon tea brand Wonderfarm pays record dividends.

International Food Joint Stock Company, formerly International Food Processing Industry Company (IFPI), was established on November 16, 1991. The initial investor was Trade Ocean Holdings Sdn.Bhd Company headquartered in Penang, Malaysia.

The main activities of the Company are the production of beverages, processed foods, processing agricultural and aquatic products into canned, dried, frozen, salted and pickled products...

The company's outstanding products are Wonderfarm branded soft drinks such as winter melon tea, bird's nest drink, coconut water, passion fruit...

Previously, in 2007, Interfood was listed on HoSE with a charter capital of 291 billion VND . At that time, the company's profit was around 60 billion VND per year.

However, the investment was ineffective. In 2008, Interfood suffered a net loss of more than 200 billion VND and continued to suffer losses for many years after that.

By 2011, the Malaysian investor decided to leave Interfood. Instead, the Japanese Kirin Group stepped in to "rescue" it by acquiring more than 57% of the company's capital.

After the above deal, Kirin continuously injected more capital into Interfood through private share issuances. By 2015, Interfood's charter capital increased to VND871 billion and has been maintained to this day. In Interfood's shareholder structure, the Japanese side holds 96% of the shares.

After a long period of restructuring operations under Japanese management, Interfood began to make profits again in 2016 with a profit of 43 billion VND . In the same year, Interfood shares returned to the UPCoM floor after being delisted from the HoSE floor in 2013.

Interfood's current product portfolio includes winter melon tea, bird's nest drink, fruit juice, coconut milk, green tea, latte, coffee and milk under the Wonderfarm and Kirin brands.

Interfood's current product portfolio includes winter melon tea

Interfood has achieved 49% of its revenue plan and 55% of its profit target for the year.

In the financial report for the second quarter of 2024, Interfood recorded net revenue of nearly VND 525 billion , an increase of 10% over the same period last year. Of which, the beverage segment alone brought in more than VND 425 billion , accounting for 81% of total revenue.

However, after deducting expenses, Interfood's after-tax profit in the second quarter of 2024 reached VND 55 billion , down about 24% over the same period in 2023.

Interfood representative said net revenue increased by 10% over the same period mainly due to the company's continued efforts to implement the proposed sales plan, focusing strongly on key product lines and strategic products.

Cost of goods sold in the second quarter remained at 63% of net revenue, equal to the same period last year.

However, the 20% increase in selling expenses to nearly VND110 billion has caused Interfood's profits to decline. Of these expenses, the portion spent on promotional programs and strengthening communication campaigns to promote strategic products to boost sales growth accounted for VND29 billion , a sharp increase of 82% compared to the second quarter of 2023.

In the first 6 months of the year, International Food - owner of the Wonderfarm winter melon tea brand recorded nearly 972 billion VND in net revenue and 105 billion VND in net profit, up 11% and 3% respectively over the same period. With the results achieved, the company has achieved 49% of the revenue plan and 55% of the profit target for the whole year.

In 2024, Interfood set a record high net revenue target of VND1,993 billion (the highest business plan ever), an increase of nearly 7% compared to last year's performance. However, the company was quite cautious when setting pre-tax and after-tax profit targets of VND240 billion and VND192 billion, respectively, down 9% and 8% compared to last year's performance.

Source: https://danviet.vn/thuc-pham-quoc-te-wonderfarm-sap-chia-co-tuc-ky-luc-20240729113032608.htm

Comment (0)