Demand for townhouses and villas is changing positively.

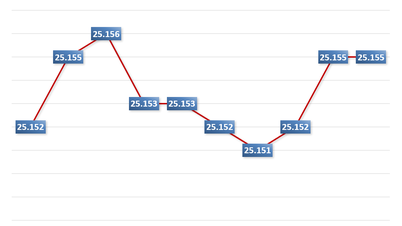

According to DKRA Group, in the second quarter of 2025, the primary supply of townhouses and villas in the Da Nang market and surrounding areas increased by 4% over the same period, but was still low compared to the period before 2022. Most of it came from the inventory of old projects, accounting for 88% of the total supply in the whole market.

In the second quarter of 2025, the supply of resort real estate in Da Nang and surrounding areas will decrease, and the market consumption rate will be modest.

Da Nang (old) and Hue City lead the market, accounting for 80% of total supply and more than 70% of total primary consumption. The primary selling price increased by an average of 10% over the same period; the secondary market also increased by an average of 4% compared to the end of 2024, mainly focusing on projects that have been handed over, have completed legal procedures and convenient infrastructure connections.

According to DKRA Group's forecast, in the third quarter of 2025, the new supply of townhouses and villas will increase compared to the second quarter, fluctuating between 100 and 200 units on the market. Overall demand may increase slightly compared to the second quarter, but there is unlikely to be a sudden change in the short term.

The primary price level remains stable, preferential policies and discounts for quick payment continue to be applied in the third quarter. The secondary market may improve compared to the previous quarter, focusing mainly on products that have been handed over with completed legal documents and convenient connectivity.

The resort real estate market is gloomy

The resort real estate segment recorded a low supply compared to the same period last year and most of it came from inventory from previously launched projects. The primary selling price level did not fluctuate much, continuing the sideways trend.

Of which, the primary supply of the resort villa segment decreased by about 3%, mainly from the inventory of old projects. Quang Nam (old) and Hue City continued to lead, accounting for 90% of the total supply in the whole market. In contrast, Da Nang (old) was a bright spot in liquidity, contributing 100% to the total consumption.

The market consumption rate is still modest. The primary price level has not fluctuated compared to the same period last year and remains high. However, policies on profit sharing, revenue, principal grace period, interest support... continue to be widely applied by investors to increase liquidity.

In the resort townhouse/shophouse segment, primary supply remains low, new projects are scarce and there have been no transactions in the quarter. Primary selling prices are stable and have not fluctuated much compared to the same period. Current asking prices range from VND7.1 to VND16.3 billion/unit; the secondary market continues to remain gloomy.

In the condotel segment, in the second quarter of 2025, primary supply decreased slightly by 1% compared to the same period; 100% came from inventory of old projects, there was no new supply. Quang Nam (old) and Da Nang played a leading role in the market, accounting for 93% of the total primary supply. Market demand remained low. Primary price levels did not fluctuate much compared to the same period and continued to trend sideways.

DKRA Group forecasts that in the third quarter of 2025, new supply in the resort real estate segment is likely to continue to be absent due to investors being more cautious in implementing sales, while liquidity remains difficult. The primary price level remains stable and has not fluctuated much compared to the previous quarter. Policies to support interest rates, principal grace period, payment schedule extension, etc. will continue to be applied by many investors in the third quarter of 2025.

Source: https://doanhnghiepvn.vn/kinh-te/da-nang-nguon-cung-bat-dong-san-nghi-duong-giam-chu-yeu-hang-ton/20250719072841157

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

Comment (0)