The Deputy Governor stated that, from the beginning of 2025 until now, the global economy has continued to face numerous risks and uncertainties stemming from tariff policies, geopolitical tensions, and the unpredictable monetary policy trajectories of major central banks. Domestically, businesses continue to face many difficulties in production and operations, and consumption and exports are affected by the complex and unpredictable developments in the global economy as well as international financial markets.

In this context, the Government aims for economic growth of 8.3-8.5% in 2025, laying the foundation for double-digit growth in subsequent years. The State Bank of Vietnam recognizes this as an extremely important political task, requiring decisive action.

Accordingly, the State Bank of Vietnam has proactively and promptly implemented a comprehensive set of management solutions to promote economic growth while maintaining macroeconomic stability, controlling inflation, and ensuring the major balances of the economy.

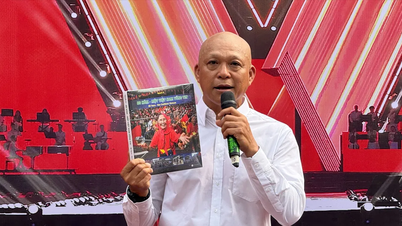

|

| Deputy Governor of the State Bank of Vietnam, Pham Thanh Ha, provided information on the direction of monetary and credit policy aimed at achieving the goals of controlling inflation and stabilizing the macroeconomy from now until the end of the year. |

To date, the results achieved include ensuring liquidity in the credit institution system, maintaining a stable money market, and ensuring flexible exchange rate movements in line with market conditions.

Specifically, lending interest rates continued their downward trend. By the end of August 2025, the average lending interest rate decreased by approximately 0.6% compared to the end of 2024. The foreign exchange market maintained smooth liquidity, and legitimate foreign currency needs were met fully and promptly; by the end of August 2025, the average interbank exchange rate increased by 3.45% compared to the end of the previous year.

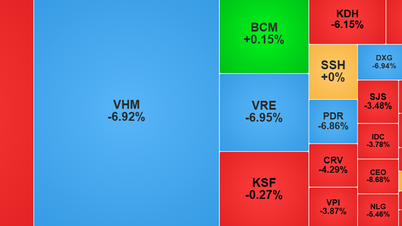

Regarding credit, growth has been positive compared to recent years. As of August 29, 2025, outstanding credit in the entire economy reached VND 17.46 million billion, an increase of 11.82% compared to the end of 2024.

Credit programs and policies directed by the Government and the Prime Minister continue to be implemented vigorously and effectively by credit institutions, thereby providing timely capital to the economy. These results have made a significant contribution to controlling inflation in line with the set target.

According to the Deputy Governor, the global economic outlook in the coming period still harbors many difficulties, challenges, and increasing risks, requiring policy management to closely monitor the situation, be proactive, flexible, and effective. Based on the socio-economic development orientation of the Party, the National Assembly, and the Government, the State Bank of Vietnam will focus on five key groups of solutions.

Firstly, flexible and synchronized management of monetary policy tools and solutions with appropriate timing and dosage, harmonizing exchange rates and interest rates, creating favorable conditions for production and business, thereby promoting growth, ensuring macroeconomic stability, and controlling inflation according to targets.

Secondly, continue to manage the exchange rate flexibly, closely monitoring market developments, and be ready to intervene when necessary to ensure the stability of the foreign exchange market.

Thirdly, direct credit institutions to continue their efforts to reduce operating costs and accelerate digital transformation, thereby striving to lower lending interest rates and contribute to supporting businesses and people.

Fourth, credit management should be aligned with macroeconomic developments and the economy's capacity to absorb capital, ensuring timely provision of funds to the economy.

Fifth, continue to coordinate closely with ministries and agencies to promptly resolve difficulties in implementing credit policies, creating favorable conditions for businesses and people to access bank credit.

"During the course of its operations, the State Bank of Vietnam will continue to closely monitor domestic and international economic developments to promptly adjust monetary policy flexibly and appropriately to meet practical requirements," Deputy Governor Pham Thanh Ha affirmed.

Source: https://baolamdong.vn/dieu-hanh-chinh-sach-tien-te-linh-hoat-de-kiem-soat-lam-phat-on-dinh-vi-mo-390375.html

Comment (0)