On the morning of October 17th, continuing the 50th session, the Standing Committee of the National Assembly discussed and approved a Resolution on adjusting the personal income tax deduction for dependents, applicable from the tax year 2026, with the tax settlement date being in the first quarter of 2027. Deputy Chairman of the National Assembly Nguyen Duc Hai chaired the discussion session.

On behalf of the Government, Deputy Minister of Finance Nguyen Duc Chi presented the draft Resolution of the National Assembly Standing Committee on adjusting the personal income tax deduction for dependents, stating that adjusting the deduction is considered necessary to suit the socio-economic situation and price fluctuations, in order to reasonably and fairly encourage income collection and create incentives for taxpayers to accumulate and consume, contributing to promoting economic growth.

The government has submitted two options to the National Assembly Standing Committee for adjusting the personal allowance deduction.

Option 1 is to adjust the family deduction level according to the CPI growth rate. Deputy Minister of Finance Nguyen Duc Chi said that according to data from the General Statistics Office, in the period from 2020 to the end of 2025, the cumulative CPI is expected to fluctuate by 21.24%, so it can be considered to adjust accordingly to the CPI growth rate. Specifically, the deduction level for the taxpayer himself will increase from 11 million VND/month to about 13.3 million VND/month (an increase of about 21.24% compared to the current level); the deduction level for each dependent will increase from 4.4 million VND/month to 5.3 million VND/month (an increase of about 21.24% compared to the current level).

Implementing this plan, the state budget is expected to decrease by about 12,000 billion VND/year compared to the revenue level and number of taxpayers according to current regulations.

Under Option 2, the personal allowance is adjusted according to the growth rate of average per capita income and the growth rate of average per capita GDP.

According to the General Statistics Office, the fluctuation in per capita income and per capita GDP from 2020 to the present is approximately 40-42%. Therefore, based on the growth rate of per capita income and per capita GDP in 2025 compared to 2020 as mentioned above, the personal allowance deduction can be adjusted as follows:

The personal tax deduction will increase from VND 11 million/month to approximately VND 15.5 million/month (an increase of about 40.9% compared to the current level); the deduction for each dependent will increase from VND 4.4 million/month to approximately VND 6.2 million/month (an increase of about 40.9% compared to the current level).

Deputy Minister Nguyen Duc Chi said that according to this plan, an individual taxpayer (if there are no dependents) with an income of 17 million VND/month, after deducting insurance premiums of 10.5% (8% social insurance + 1.5% health insurance + 1% unemployment insurance), will have 1.785 million VND (17 million VND x 10.5%) + 15.5 million VND (deduction for the taxpayer himself) = 17.285 million VND, therefore, with an income of 17 million VND/month, this person still does not have to pay tax. The income exceeding 17.285 million VND/month will be subject to tax at a tax rate starting at 5%.

According to Deputy Minister Nguyen Duc Chi, implementing this plan is expected to reduce the state budget by approximately 21,000 billion VND per year compared to the current revenue levels and number of taxpayers as stipulated in the regulations.

In summary, Deputy Minister Nguyen Duc Chi stated that the majority of opinions agreed with Option 2, based on the criteria of the growth rate of average per capita income and the growth rate of average per capita GDP, with an increase of approximately 40% to 42% from 2020 to the present.

The government proposes that this Resolution take effect from the date of signing and apply from the 2026 tax year.

In a summary report reviewing the Government's submission, Phan Van Mai, Chairman of the National Assembly's Economic and Finance Committee, stated that the Standing Committee agreed on the necessity of adjusting the personal income tax deduction for taxpayers and their dependents to align with the socio-economic situation and price fluctuations. This would contribute to a reasonable and fair collection of income, create incentives for taxpayers to accumulate and consume, and ultimately promote economic growth.

However, Mr. Phan Van Mai stated that the Government had submitted Document No. 844/TTr-CP dated September 29, 2025, on the draft Law on Personal Income Tax (amended), which includes a proposal to amend and supplement regulations on the personal allowance for taxpayers and dependents. The Standing Committee of the National Assembly met and commented on the draft Law on Personal Income Tax (amended) and concluded that it is necessary to combine the draft Law on Personal Income Tax (amended) and the draft Resolution on adjusting the personal allowance to address the issue simultaneously and specify in the Law the personal allowance for taxpayers and dependents, granting the Government the authority to submit to the Standing Committee of the National Assembly for consideration and adjustment of the personal allowance in necessary cases (similar to the provisions of the current Law on Personal Income Tax).

Therefore, from the perspective of the timing of issuance, the Standing Committee of the Economic and Financial Committee believes that the issuance of a separate Resolution by the National Assembly Standing Committee to adjust the family deduction level at the present time - at the same time as the National Assembly Standing Committee and the National Assembly are reviewing the draft Law on Personal Income Tax (amended) to amend the Law in a comprehensive manner and expected to pass it at the 10th Session - is not really appropriate, creating unnecessary complications for taxpayers in implementation.

Regarding the adjustment of the personal income tax deduction for dependents, Phan Van Mai, Chairman of the National Assembly's Economic and Finance Committee, stated that the majority of opinions within the Standing Committee agreed with the direction of increasing the deduction based on the average per capita income growth rate and the average per capita GDP growth rate (Option 2), and basically agreed with the deduction level proposed by the Government.

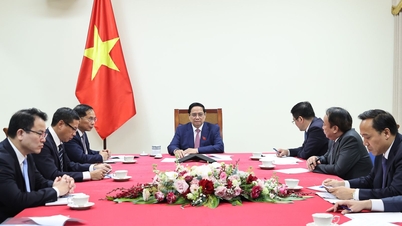

Following discussions among members of the National Assembly Standing Committee, the opinions of the State Audit Office, and explanations from government representatives, in his concluding remarks at the discussion session, National Assembly Vice Chairman Nguyen Duc Hai stated that the members of the National Assembly Standing Committee unanimously agreed with the contents proposed in the Government's submission.

The Standing Committee of the National Assembly will issue a resolution on the duration and amount of personal income tax deductions for dependents, as proposed by the Government. The Standing Committee also requested the Government to study the opinions raised at this session, such as considering necessary and appropriate content regarding the deduction amount, tax period, and application, in order to facilitate the amendment of the Personal Income Tax Law.

The Standing Committee of the National Assembly voted to approve a Resolution on adjusting the personal income tax deduction for dependents. Also at the session, the Standing Committee of the National Assembly approved a Resolution on the environmental protection tax rate for gasoline, diesel, and lubricants in 2026.

(VNA/Vietnam+)

Source: https://www.vietnamplus.vn/uy-ban-thuong-vu-quoc-hoi-thong-qua-nghi-quyet-dieu-chinh-muc-giam-tru-gia-canh-post1070896.vnp

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[Podcast] National Assembly approves personal allowance deduction of VND 15.5 million/month](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765340032834_hnm-1cdn-vn-thumbs-540x360-2025-11-04-_hnm-1cdn-vn-thumbs-540x360-2025-06-27-a7b22b8722-_thu.jpeg)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)