Domestic gold prices today

Early this morning, July 26th , the price of 9999 gold from SJC decreased by 100,000 VND/ounce for both buying and selling compared to the closing price yesterday.

The price of 9999 gold was updated by Saigon Jewelry Company Limited (SJC) at 8:34 AM, and the price of 9999 gold was listed by Doji Gold and Jewelry Group at 8:45 AM as follows:

| Buy | Sell | |

| SJC Hanoi | 66,550,000 VND/ounce | 67,170,000 VND/ounce |

| SJC Ho Chi Minh City | 66,550,000 VND/ounce | 67,150,000 VND/ounce |

| SJC Da Nang | 66,550,000 VND/ounce | 67,170,000 VND/ounce |

| Doji Hanoi | 66,550,000 VND/ounce | 67,250,000 VND/ounce |

| Doji Ho Chi Minh City | 66,600,000 VND/ounce | 67,100,000 VND/ounce |

Updated gold prices for SJC and DOJI at the beginning of the morning on July 26th.

At the close of trading on July 25th, the domestic price of 9999 gold was listed by SJC and Doji Gold and Gemstone Group in the following order for buying and selling:

SJC Hanoi: 66,650,000 VND/ounce - 67,270,000 VND/ounce

Doji Hanoi: 66,550,000 VND/ounce - 67,250,000 VND/ounce

SJC Ho Chi Minh City: 66,600,000 VND/ounce - 67,200,000 VND/ounce

Doji Ho Chi Minh City: 66,600,000 VND/ounce - 67,100,000 VND/ounce

The central exchange rate for July 26th , announced by the State Bank of Vietnam, is 23,746 VND/USD, a decrease of 14 VND compared to yesterday. The USD price at commercial banks this morning (July 26th) is trading around 23,465 VND/USD (buying) and 23,835 VND/USD (selling).

International gold price today

At 9:29 AM today (July 26th, Vietnam time), the spot price of gold in the world market stood around $1,962.2 per ounce, an increase of $5.2 per ounce compared to last night. The price of December gold futures on the Comex New York exchange was $2,003.5 per ounce.

On the night of July 25th (Vietnam time), the spot price of gold in the world market stood around $1,957 per ounce. Gold futures for December delivery on the Comex New York exchange were at $1,981 per ounce.

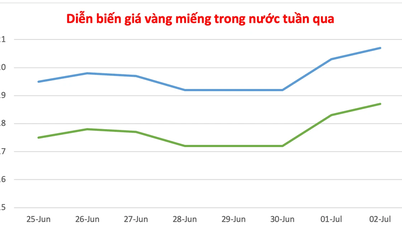

World gold prices on the night of July 25th were approximately 7.3% (US$133/ounce) higher than at the beginning of 2023. Converted using the bank's USD exchange rate, world gold was priced at VND 56.7 million/ounce, including taxes and fees, which is about VND 10.5 million/ounce lower than domestic gold prices as of the end of the trading session on July 25th.

Gold prices on the international market are under downward pressure ahead of the sensitive period when the US Federal Reserve (Fed) is about to make a decision on monetary policy.

The Fed began its two-day policy meeting on July 25-26.

Signals from the CME Group trading platform indicate that, as of 8:50 PM on July 25th (Vietnam time), 98.3% of investors predicted the Fed would raise the benchmark interest rate by 25 basis points at its meeting on July 25-26. This percentage was lower than the 99.6% recorded the previous day.

Previously, the Fed paused interest rate hikes in June after 10 consecutive rate increases since March 2022, totaling 500 basis points, from a record low of 0-0.25% per year to 5-5.25% per year.

If the Fed raises interest rates at its July 25-26 meeting, the US federal funds rate will rise to 5.25-5.5% - the highest level since 2001.

The market also forecasts that the Fed will raise interest rates once more in September. At that point, the US fund Fed rate will be around 5.5-5.75%.

Gold prices also came under downward pressure as stock markets in many Asian countries rose and US stocks also trended upward on July 25.

Gold price forecast

Hong Kong stocks rose more than 4% after China pledged support for its property market.

According to Kitco, gold prices are under downward pressure in the short term due to further interest rate hikes by the Fed. However, in the long term, the precious metal is trending upwards as the USD is about to reverse its downward trend when the Fed ends its monetary policy tightening cycle.

If the Chinese economy recovers and grows rapidly thanks to the ongoing real estate support policies, predictions of declining demand for gold in the country may no longer be accurate. This would give gold another factor supporting its price increase.

Source

Comment (0)