The government has recently issued Decree No. 182/2025/ND-CP dated July 1, 2025, amending and supplementing several articles of Decree No. 134/2016/ND-CP detailing the implementation of the Law on Export and Import Taxes (Decree 182). Of particular note is the provision exempting import tax on goods serving the development of science and technology, innovation, and the digital technology industry.

Accordingly, from July 1, 2025, imported goods serving scientific, technological, innovation, and digital technology industry activities will be exempt from import tax as stipulated in Clause 3, Article 5 of Law No. 90/2025/QH15 – Law amending and supplementing a number of laws related to investment, tax, and public finance.

The specific types of goods eligible for tax exemption will be determined by the Ministry of Science and Technology , for cases falling under points a, c, and d of Clause 21, Article 16 of the amended Law on Export and Import Taxes. For goods falling under point b of Clause 21, the determination will be based on Clause 4, Article 14 of the new decree.

Furthermore, the start date of production or trial production by the enterprise is also clearly stipulated. Taxpayers are responsible for self-declaring and taking responsibility for the actual start date of production activities and must notify the customs authority in advance when submitting the list of tax-exempt goods.

After the 5-year tax exemption period, if imported raw materials, supplies, and components are not fully used, the enterprise must declare and pay the full tax on the remaining goods.

Regarding procedures, tax exemption applications will be processed according to Article 31 of this decree. Specifically for goods falling under point a, clause 21, in addition to the general regulations, other relevant documents may be required.

In addition, Decree 182 also amends and supplements the regulations in Article 30 regarding cases requiring notification of the list of tax-exempt goods expected to be imported, applicable to goods under points b, c, and d of Clause 21, Article 16 of the amended Law, as well as provisions from Article 14 to Article 18 and Article 23 of Decree 134/2016/ND-CP.

Furthermore, this decree repeals the entirety of Article 19 of Decree 134/2016/ND-CP.

Source: https://doanhnghiepvn.vn/cong-nghe/mien-thue-nhap-khau-hang-hoa-phuc-vu-phat-trien-khoa-hoc-cong-nghe/20250703111456778

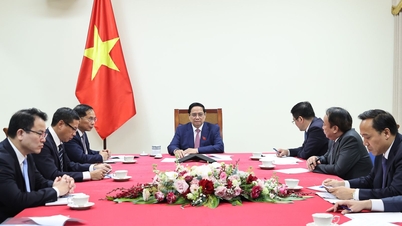

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)