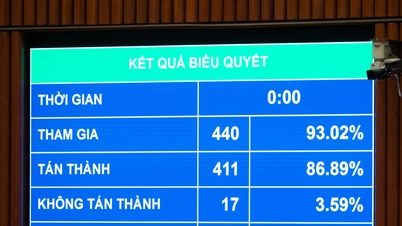

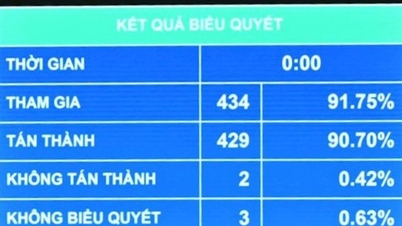

Deposits made by individuals owning more than 5% of the charter capital and related parties will not be covered by deposit insurance.

The Law on Deposit Insurance (amended) has 8 Chapters and 41 Articles regulating deposit insurance activities; the rights and obligations of deposit insurance beneficiaries, deposit insurance participating organizations, the deposit insurance organization, and state management of deposit insurance.

The law clearly stipulates that deposit insurance aims to protect the legitimate rights and interests of depositors; contribute to maintaining the stability of the credit institution system, and ensure the safe and sound development of banking operations.

Credit institutions and branches of foreign banks that accept individual deposits must participate in deposit insurance; policy banks are not required to participate in deposit insurance.

According to the Law on Deposit Insurance (amended), insured deposits are deposits in Vietnamese Dong made by individuals at deposit insurance participating institutions in the form of time deposits, demand deposits, savings deposits, certificates of deposit, and other forms of deposits as prescribed by law on credit institutions, except for the types of deposits specified in Article 18 of this Law.

Uninsured deposits include: deposits at credit institutions by individuals who own more than 5% of the charter capital of that credit institution; and deposits by individuals or related parties who own more than 5% of the charter capital of that credit institution. Related parties are determined according to the provisions of the law on credit institutions.

In addition, some other types of deposits are not insured, including: deposits at credit institutions by individuals who are managers, executives, or members of the Supervisory Board of that credit institution; deposits at branches of foreign banks by individuals who are the General Director (Director), Deputy General Director (Deputy Director) of that foreign bank branch; mandatory savings deposits at microfinance institutions as prescribed by law; and funds used to purchase bearer securities issued by deposit insurance participating institutions.

Regarding deposit insurance fees, the Law stipulates that the Governor of the State Bank of Vietnam shall prescribe the deposit insurance fee rates, and the application of uniform or differentiated deposit insurance fees in accordance with the specific characteristics of the credit institution system in Vietnam in each period.

Credit institutions under special supervision are exempt from paying deposit insurance fees. In cases where the deposit insurance organization borrows special funds from the State Bank of Vietnam as stipulated in Article 38 of this Law, the deposit insurance organization may develop a plan to increase deposit insurance fees to compensate for the special loan from the State Bank of Vietnam. This plan must include at least details on the duration and amount of the fee increase and submit it to the State Bank of Vietnam for consideration and decision.

The State Bank of Vietnam will inspect, audit, and handle violations.

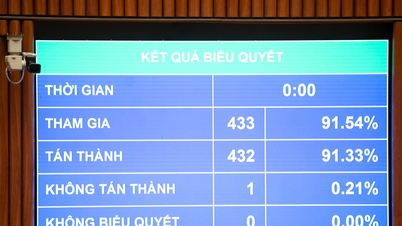

Earlier, the National Assembly heard the Governor of the State Bank of Vietnam, Nguyen Thi Hong, present the report on the acceptance and explanation of the opinions of the Standing Committee of the National Assembly on the draft Law on Deposit Insurance (amended).

Accordingly, the Government proposes incorporating and revising the draft Law by adding to Article 16 of the draft Law the form of publicly disclosing participation in deposit insurance on the website of the deposit insurance organization.

Based on the opinion of the Standing Committee of the National Assembly regarding the review, research, and reference to the provisions of the law on inspection in the regulations on state management responsibility for deposit insurance inspection, Clause 2 of Article 9 of the draft Law on the State Management Responsibility for Deposit Insurance of the State Bank of Vietnam is amended to include inspection, investigation, handling of violations, and resolution of complaints and denunciations regarding deposit insurance in accordance with this Law and relevant laws, except for the provisions in Article 10 of this Law.

The provision "in accordance with this Law and relevant laws" will include both inspection laws and other relevant laws such as laws on handling violations, resolving complaints and denunciations.

At the same time, the provision in Article 42 of the draft Law that assigns the Government the task of providing guidance on the implementation of this Law should be removed.

The government proposes that the effective date of the amended Law on Deposit Insurance be May 1, 2026.

Source: https://daibieunhandan.vn/quoc-hoi-thong-qua-luat-bao-hiem-tien-gui-sua-doi-10399881.html

![[Photo] The captivating scenery of the fragrant maple forest in Quang Tri](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F10%2F1765353233198_lan09046-jpg.webp&w=3840&q=75)

![[Photo] Explore the US Navy's USS Robert Smalls warship](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F10%2F1765341533272_11212121-8303-jpg.webp&w=3840&q=75)

![[Infographic] Progress of drafting the Law on Deposit Insurance (amended)](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/02/1764634623165_z4503972187742-e86f53ddc73de4234b8edd143f53681e20251201152033.jpeg)

![[Video] The craft of making Dong Ho folk paintings has been inscribed by UNESCO on the List of Crafts in Need of Urgent Safeguarding.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765350246533_tranh-dong-ho-734-jpg.webp)

Comment (0)