Profit down 16.4%, Nam Tan Uyen at risk of missing yearly plan

Nam Tan Uyen Industrial Park Joint Stock Company (Code: NTC) is a reputable industrial park real estate developer in Binh Duong . In the third quarter of 2024, Nam Tan Uyen recorded net revenue of VND 51.2 billion, down 5.7% over the same period. Of which, gross profit reached VND 33.8 billion, gross profit margin decreased from 70.2% to 65.9%.

During the period, financial revenue decreased by 21.2% to VND48.6 billion. Sales expenses and administrative expenses during the period remained unchanged, accounting for VND8.6 billion. Other activities fluctuated insignificantly.

Nam Tan Uyen (NTC) profit decreased by 16.4%, debt is 3 times more than equity (Photo TL)

After deducting all operating expenses and taxes, Nam Tan Uyen's after-tax profit reached VND64.2 billion, down 16.4% over the same period last year.

The reason for the decline in profits comes from the decline in revenue. Along with that, the loss of financial revenue while operating costs remain the same also causes the company's profits to be significantly eroded.

Nam Tan Uyen's cumulative revenue in the first 9 months of 2024 was recorded at 176.9 billion VND, down 2.6%. Profit after tax reached 195.1 billion VND, down 15.9% over the same period. Compared to the target set for 2024 with revenue of 698.4 billion VND, profit after tax of 278.2 billion VND, Nam Tan Uyen has only completed 70.1% of the target, the company is behind schedule.

Liabilities are three times higher than equity.

Nam Tan Uyen's asset size at the end of September was recorded at VND4,527.7 billion, down 0.8% compared to the beginning of the year. Of which, other long-term assets accounted for VND1,773.8 billion, equivalent to 39.2% of total assets.

Notably, cash and long-term financial investments accounted for 33.5% of total assets, equivalent to VND1,518.7 billion. Long-term financial investments were recorded at VND635.3 billion, equivalent to 14%.

Regarding the capital structure, payables account for a relatively large proportion of VND 3,371 billion, 3 times higher than equity. Of which, the long-term debt is mainly long-term unrealized revenue, accounting for VND 2,857 billion. This is the amount of money collected from partners but not yet realized revenue.

Owner's equity currently accounts for VND1,157 billion, equivalent to 25.5% of total capital. Undistributed profit after tax at the end of Q3 increased to VND547 billion.

According to the company, the Nam Tan Uyen project phase 2 has not yet started. The project is taking the initial steps of consulting, surveying and designing, implementing compensation and site clearance and has been decided to allocate land in the first phase with an area of 344.33 hectares and the remaining area is proposed to allocate land in the second phase. Nam Tan Uyen is in the process of applying for a construction permit and implementing the project after being licensed.

Source: https://www.congluan.vn/nam-tan-uyen-ntc-loi-nhuan-quy-3-di-lui-no-phai-tra-cao-gap-3-lan-von-chu-post316852.html

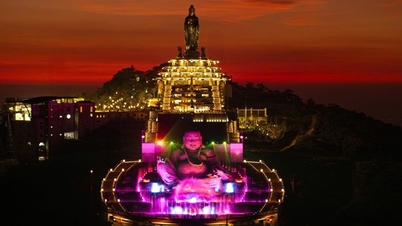

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

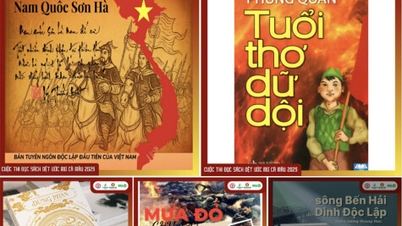

![[Infographic] 3 important milestones of the "Quang Trung Campaign"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/04/1764800248456_fb_ava-2.jpeg)

Comment (0)