|

The US dollar fell this morning after the Federal Reserve offered a more dovish outlook than some investors had expected, boosting their confidence to short the greenback amid bets on two more interest rate cuts in 2026.

At the conclusion of its two-day policy meeting, the Fed lowered interest rates by 25 basis points, as expected. However, Chairman Jerome Powell's remarks at the subsequent press conference surprised many investors, especially those who had anticipated a more hawkish stance.

“For us, the biggest takeaway from the meeting was the more ‘dovish’ tone in Chairman Powell’s accompanying remarks and press conference,” said Nick Rees, head of macro research at Monex Europe.

As a result, investors sold off USD, pushing the euro above the key 1.17 USD mark and close to its two-month high of 1.1705 USD in Thursday morning's Asian trading session.

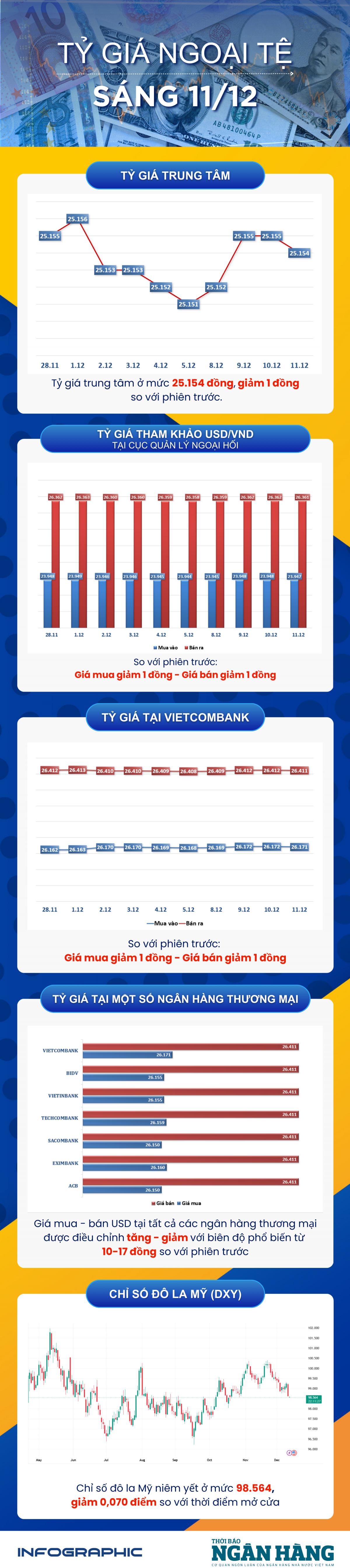

The British pound touched a 1.5-month high at $1.3391, while the yen, which has recently been pressured by the large interest rate differential between Japan and other countries, rose 0.25% to 155.64 yen/USD. Against a basket of currencies, the USD fell to its lowest level since October 21, in the 98.543 point range.

“I think many people expected the Fed to repeat its hawkish stance from the October meeting. But this time the tone was completely different: less hawkish commentary, a more supportive bond-buying program, and a less hawkish vote than the market had predicted,” said Tony Sycamore, an expert at IG Group.

"To me, this is a 'green light' signal for an upward trend in risky assets from now until the end of the year," he added.

The meeting's outcome further reinforced market expectations that the Fed will cut interest rates two more times next year, contrary to the Fed's own median forecast of just a 25 basis point reduction.

The Fed also announced it will begin purchasing short-term government bonds to manage market liquidity starting December 12, with the first tranche being approximately $40 billion in Treasury bills.

This move supported the bond market, pushing the yield on 2-year US Treasury bonds down 3 basis points to 3.5340%, while the yield on 10-year bonds also fell by a similar amount to 4.1332% (yields fall when bond prices rise).

"The earlier timing and larger-than-expected scale of the treasury bill purchases caught the market by surprise, creating a sharp price surge led by short-term maturities," analysts at Societe Generale wrote in a report.

In other currency markets, the Australian dollar fell 0.14% to $0.66665, retreating from near a three-month high in the previous session; while the New Zealand dollar declined 0.07% to $0.5812.

Source: https://thoibaonganhang.vn/sang-1112-ty-gia-trung-tam-giam-1-dong-174964.html

![[Infographic] Cross-exchange rates for determining taxable value from December 11-17](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765413245543_infographic-ty-gia-tinh-cheo-de-xac-dinh-tri-gia-tinh-thue-tu-11-1712-20251211021920.jpeg)

![[Infographic] Cross-calculated exchange rates to determine taxable value from December 4-10](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/04/1764832340841_infographic-ty-gia-tinh-cheo-de-xac-dinh-tri-gia-tinh-thue-tu-4-1012-20251204120447.jpeg)

Comment (0)