The People's Bank of China (PBoC) continued to add gold to its reserves in August, marking the 10th consecutive month of purchases. This move reflects Beijing's efforts to diversify its foreign exchange reserves and reduce its dependence on the US dollar, according to Bloomberg.

As of the end of August, China's gold reserves reached 74.02 million ounces, up from 73.96 million ounces at the end of July. This is equivalent to $253.84 billion, up from $243.99 billion the previous month, according to PBoC data released on September 7th.

Since the start of its gold buying cycle last November, China has accumulated a total of 1.22 million ounces of gold.

"Although China's gold purchasing pace has slowed since the beginning of the year, the PBoC continues to add to its reserves even as prices escalate," Adrian Ash, research director at online trading platform BullionVault, noted in a report.

"Beijing's persistent accumulation of gold is a clear signal of its confidence in gold as a long-term reserve asset. At the same time, this move also reinforces confidence in gold among Chinese investors and households," he emphasized.

Gold bars in a vault in Germany (Photo: Reuters).

Since the beginning of the year, global gold prices have continuously reached record highs, increasing by more than 30% and currently surpassing the $3,500/ounce mark. This price surge is driven by expectations that the US Federal Reserve (Fed) will cut interest rates, along with statements from President Donald Trump regarding the Fed's independence.

Goldman Sachs, an investment bank, forecasts that if the Fed's independence erodes, the price of gold could approach $5,000 per ounce. Gold is considered a safe haven for investors, so the precious metal typically rises in value when interest rates are low and uncertainty increases.

The World Gold Council (WGC) said in its latest report that the pace of gold purchases by global central banks has slowed due to high prices, but geopolitical tensions remain a factor sustaining demand.

Commerzbank forecasts that the $3,600/ounce mark is entirely achievable by the end of this year. UBS also raised its gold price forecast to around $3,600-$3,700/ounce.

Source: https://dantri.com.vn/kinh-doanh/trung-quoc-gom-vang-10-thang-lien-tiep-bac-kinh-tinh-toan-gi-20250908150055621.htm

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

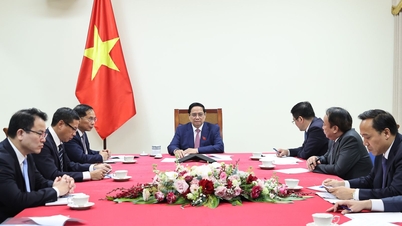

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)