Speaking at the discussion, comrade Ma Thi Thuy, Deputy Head of the Provincial Delegation of National Assembly Deputies, agreed with the Report as well as the opinion of the National Assembly Standing Committee on the necessity of amending a number of articles of the Law on Value Added Tax.

|

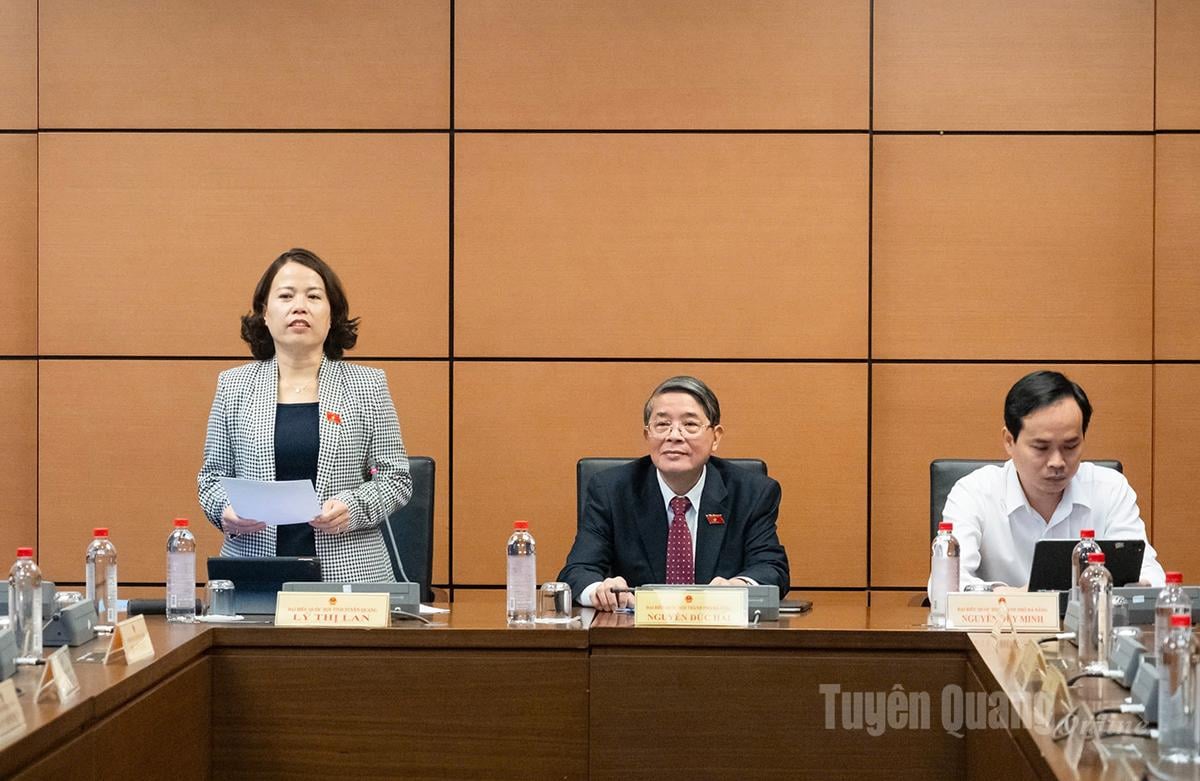

| Provincial National Assembly delegation at the discussion session in the Hall. |

Regarding this content, the amendment in Article 1, delegates said that it has a direct impact on millions of farming households, cooperatives as well as many businesses in the production chain. The draft expands the subjects not subject to VAT for unprocessed agricultural, forestry and fishery products when businesses and cooperatives sell to each other. This is a suitable step to reduce intermediary costs, remove obstacles in deduction and declaration. However, delegates are concerned that the concept of "normal preliminary processing" has not been clearly defined, while this is the point of controversy for many years, leading to the situation where the same type of goods is applied differently by each locality; businesses are always in a state of both declaring and worrying about the risk of being taxed. Assigning the Ministry of Finance to specify details without specific principles in the law can easily lead to arbitrary interpretations, even administratively expanding or narrowing the subjects. Delegates suggested that the principles should be stipulated in the law, at least defining criteria for identifying unprocessed products to ensure policy stability.

|

| Head of the National Assembly Delegation of the province Ly Thi Lan co-chaired the discussion. |

Regarding the regulation on waste, by-products, and scrap, applying tax rates according to the goods is reasonable. However, is this regulation enough to solve the situation of buying and selling invoices and legalizing scrap for tax fraud? If we only amend the tax rates without tightening the control process, electronic invoices, and tracing of goods, the risk of revenue loss is still very high. Therefore, it is necessary to re-evaluate the impact and supplement management tools.

Regarding input tax deductions for non-taxable goods and services, allowing the deduction of all input tax is theoretically positive, reducing capital costs for businesses. However, delegates emphasized: The boundary between "non-taxable" and "non-taxable" is currently very blurred. If not clarified, it will lead to arbitrary interpretations, businesses can declare in a way that maximizes their benefits, while tax authorities apply the opposite interpretation. Expanding input deductions can lead to increased pressure on tax refunds, creating additional risks of fraud if there is no electronic checking mechanism and accompanying risk assessment.

|

| Delegate Ma Thi Thuy speaks in the discussion. |

Regarding the abolition of some conditions on documents to simplify administrative procedures, delegate Ma Thi Thuy said that it is in the right direction, but the abolition must go hand in hand with improving electronic monitoring capacity. Currently, the capacity to analyze tax data in many localities is still limited, especially in mountainous and disadvantaged areas. If the conditions are removed without solutions to increase monitoring, the risks will be greater than the benefits.

Also this morning, the National Assembly discussed in the hall the Draft Resolution on special mechanisms and policies to implement major projects in the capital; Draft Resolution amending and supplementing a number of articles on piloting special mechanisms and policies for the development of Ho Chi Minh City; Draft Resolution amending and supplementing a number of articles on the organization of urban government and piloting a number of special mechanisms and policies for the development of Da Nang city...

PV

Source: https://baotuyenquang.com.vn/thoi-su-chinh-tri/tin-tuc/202512/dai-bieu-ma-thi-thuy-can-giai-quyet-tinh-trang-mua-ban-hoa-don-hop-thuc-hoa-nham-gian-lan-thue-5982ab3/

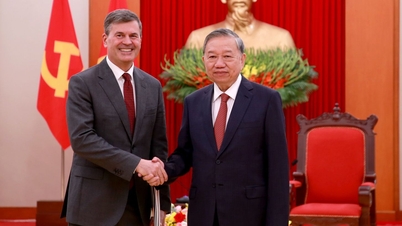

![[Photo] General Secretary To Lam receives the Director of the Academy of Public Administration and National Economy under the President of the Russian Federation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F08%2F1765200203892_a1-bnd-0933-4198-jpg.webp&w=3840&q=75)

Comment (0)