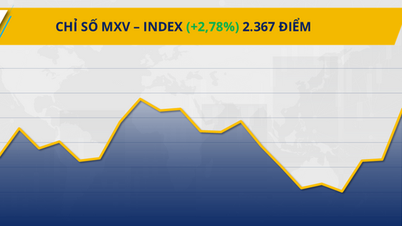

According to data from the Vietnam Commodity Exchange (MXV), the world commodity market recorded a dominant buying force in the trading session on December 4. The focus of attention was on the industrial and energy materials group, with coffee and crude oil prices both increasing sharply.

Coffee prices rise due to concerns about supply shortages

The coffee market recorded positive developments when both main commodities increased in price. Specifically, the price of Arabica coffee increased by an impressive 2.1%, closing at 8,388 USD/ton. At the same time, the price of Robusta coffee also increased by nearly 0.5%, reaching 4,232 USD/ton.

Arabica supply from Brazil is threatened

According to MXV, the rise in Arabica prices is being driven by a supply shortage from Brazil, which has boosted exports to a record 50.5 million bags in 2024, significantly reducing domestic inventories. Data from the Ministry of Development, Industry, Trade and Services (MDIC) shows that Brazil exported about 34.2 million bags in the first 10 months of the year.

Production has also declined. A report from Conab said that after the harvest ended in September, Arabica production in Minas Gerais, the largest producing state, reached 25.17 million bags, down 9.2% compared to the previous season. Similarly, production in São Paulo fell 12.9% to an estimated 4.7 million bags. The cause is attributed to an unfavorable biennial cycle and harsh climate conditions.

Weather forecaster Climatempo warned that drought and heat will continue in Brazil's main coffee growing regions next week, which could negatively affect the quality of the 2026 crop.

Vietnam faces difficulties with Robusta harvest

For Robusta, the global supply picture has also become worrying due to the complicated weather situation in Vietnam. Prolonged heavy rains causing widespread flooding in the Central Highlands region are seriously affecting the harvest progress and quality of coffee beans. Although farmers have harvested about 50-60% of the output, the storms have made drying difficult and the rate of fruit falling has increased. Market sources estimate that Vietnam's coffee output could decrease by 5% to 10% due to the impact of the weather.

The energy market is booming

In the energy market, the dominant buying force pushed up the prices of key commodities. WTI crude oil prices increased by more than 1.2% to 59.6 USD/barrel, while Brent crude oil prices also increased by more than 0.8% to 63.2 USD/barrel.

Fed rate cut expectations and geopolitical tensions

The bullish sentiment in the oil market was boosted by economic data showing a weakening US labor market, raising expectations that the US Federal Reserve will soon cut interest rates. The 10th consecutive session of weakness in the US dollar also made crude more attractive to investors holding other currencies.

On the geopolitical front, lack of progress in US-Russia talks, coupled with Ukraine’s attacks on Russian oil infrastructure, have raised concerns about supply disruptions from the Black Sea region. Additionally, news of a slight decline in OPEC production in November to 28.40 million barrels per day also contributed to price support.

Concerns about oversupply still exist

However, the rise in oil prices was still restrained by concerns about global oversupply. A report from the US Energy Information Administration (EIA) showed that the country's crude oil inventories unexpectedly increased by 574,000 barrels in the week ended November 28. Gasoline and distillate inventories also increased sharply as US refining capacity reached a high of 94.1%.

In addition, consumption is showing signs of seasonal cooling, creating a supply-demand imbalance. Fitch Ratings has also lowered its oil price forecast for the period 2025-2027, highlighting the risk from the prospect of global oversupply.

Source: https://baolamdong.vn/gia-ca-phe-va-dau-tho-dong-loat-tang-manh-trong-phien-512-408342.html

![[Photo] Cat Ba - Green island paradise](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F04%2F1764821844074_ndo_br_1-dcbthienduongxanh638-jpg.webp&w=3840&q=75)

![[Photo] 60th Anniversary of the Founding of the Vietnam Association of Photographic Artists](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F05%2F1764935864512_a1-bnd-0841-9740-jpg.webp&w=3840&q=75)

Comment (0)