Quick summary:

The US imposed a 39% tariff on imports from Switzerland due to a $48 billion trade deficit.

Refined gold is included in the tax calculation data, even though it is not directly taxed.

Switzerland argues that the value of gold comes primarily from its raw materials, not from domestic production.

Switzerland has not yet reached a trade agreement like the EU, the UK, or Japan.

Non-gold export sectors such as watches and cosmetics suffered significant losses.

The Swiss government remains moderate, but domestic economic pressures are mounting.

Why is Switzerland heavily taxed?

The sudden imposition of a 39% tariff by US President Donald Trump, the highest among developed countries, on goods imported from Switzerland is raising questions: Could the gold refining industry be the underlying cause of this new trade war?

According to the Trump administration, the reason is the large trade deficit with Switzerland, amounting to $48 billion, and the country's lack of concrete action to narrow the gap. Compared to the 15% tariff the US imposes on the entire EU, the 39% tariff specifically for Switzerland has stunned the economic community.

Switzerland is not traditionally a "cheap factory" or a mass exporter like China. However, its enormous role in the gold refining industry has inadvertently distorted trade figures.

Currently, gold, along with silver and pharmaceuticals, remains tax-exempt. However, the enormous value of gold transactions has caused Swiss exports to the US to appear unusually inflated. In the first quarter of this year alone, Switzerland exported over $36 billion worth of gold to the US.

In fact, Switzerland imports approximately 2,000 tons of gold annually from various countries, including through intermediary banks in London and New York, and then re-exports it. The value largely lies in the raw material, not the processing stage, which only generates a few hundred million USD in profit per year.

The Swiss National Bank and many experts argue that gold should not be included in the trade balance, as the industry is primarily involved in refining, not manufacturing.

The true value that Switzerland creates from gold lies in the small processing fees for producing bars, investment coins, or watch components, not reflecting large-scale manufacturing operations.

However, the US government has shown no sign of adjusting its calculation method, despite reactions from Switzerland.

Who is bearing the consequences?

In fact, sectors such as watches, cosmetics, chocolate, and precision equipment, which play a major role in exports, are among those directly impacted by the new tariffs. Over the past year, approximately 18% of Swiss exports went to the United States.

Currently, these goods will be less competitive compared to goods from the EU or the UK, as the two sides have reached an agreement on a 10% tariff with the US.

Reaction from Switzerland

Swiss President Karin Keller-Sutter traveled to Washington hoping to negotiate, but failed to meet with President Trump. Instead, she only worked with Foreign Secretary Marco Rubio, who had no authority over trade matters, and left empty-handed.

Following the failed negotiations, the Swiss Federal Council held an emergency meeting but announced it would not retaliate with tariffs. The government will focus on supporting export businesses and continuing its negotiation efforts.

However, domestic pressure is mounting. Green Party leader Lisa Mazzone has proposed a 5% tariff on exported precious metals in retaliation for US sanctions.

Although gold is not yet subject to tariffs, these new trade tensions make it even more attractive to investors seeking a safe haven.

However, the costs of transporting, insuring, and financing gold shipments will increase due to geopolitical fluctuations. These risks could erode the already thin profit margins of the refining industry.

While Switzerland has attempted a more conciliatory approach and emphasized the unique nature of its gold industry, the US has maintained a firm stance. This clash is not just about data; it's also a test of US-Switzerland trade relations in a complex geopolitical climate.

Source: https://baonghean.vn/my-ap-thue-39-voi-hang-nhap-tu-thuy-si-vi-tham-hut-thuong-mai-48-ty-usd-gia-vang-co-huong-loi-10304049.html

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

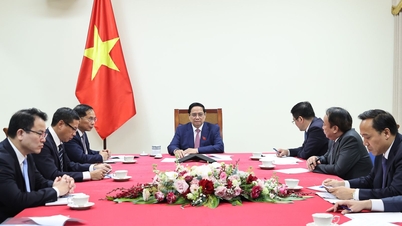

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)