Northern Power Investment and Development Joint Stock Company 2 - Nedi 2 (Code: ND2) was formerly the first subsidiary of Vinaconex (Code: VCG), primarily engaged in energy investment and development. The company currently manages and operates numerous hydropower projects in Lao Cai province and other provinces in Northern Vietnam.

Northern Power Investment and Development - Nedi 2 (ND2) reports strong Q3 profit growth, net profit margin reaches 67% (Photo: Provided)

Recently, Nedi 2 announced its Q3/2024 financial statements with net revenue reaching VND 151.9 billion, a 4.5% increase compared to the same period last year. Cost of goods sold was only VND 29 billion, and gross profit reached VND 122.6 billion. Thus, Nedi 2's gross profit margin reached 80%.

During the period, the company had to pay 12.5 billion VND in financial expenses, which is the interest on previously borrowed funds. This interest expense is even four times larger than the current business management expenses and is also the largest expense that Nedi 2 has to incur.

After deducting all expenses and taxes, Nedi 2 still earned a profit of 102 billion VND, with a net profit margin of 67%. This means that for every 100 VND in revenue, Nedi 2 earned a profit of 67 VND. Currently, Vinaconex (Code: VCG) holds a controlling stake of 51.1% in Nedi 2 and is the biggest beneficiary of these business results.

For the first nine months of the year, Nedi 2 recorded net revenue of VND 282.5 billion and after-tax profit of VND 138.1 billion, a 53% increase compared to the same period last year. This result is equivalent to achieving 76% of the revenue target and 89% of the profit target for the year.

Regarding its capital structure, Nedi 2 currently has 763.8 billion VND in liabilities. Of this, short-term debt accounts for 179.7 billion VND, and long-term debt accounts for 453.7 billion VND. During the period, the company showed a tendency to reduce its borrowings by repaying 200.9 billion VND in principal but only borrowing an additional 73.8 billion VND. This is also the reason why interest expenses were reduced during the period.

Source: https://www.congluan.vn/lam-thuy-dien-lai-nhu-vinaconex-cong-ty-con-phat-trien-dien-mien-bac-2-nd2-bien-lai-rong-len-toi-67-post317027.html

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

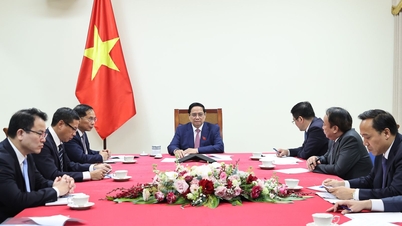

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)