Headquarters of the Central Bank of Russia in Moscow (Photo: CBR).

The European Union (EU) is looking to legalize the exploitation of profits from those funds, but Moscow warns that any such move would constitute theft.

Russian officials have repeatedly said that the seizure of state and private assets goes against all principles of the free market. Russian Finance Minister Anton Siluanov has warned of a “fully symmetrical response,” noting that there are “enough assets” in “Category C” accounts, special-purpose ruble bank accounts.

Minister Siluanov added that all those assets were frozen, "the amount is not small" and the profits from their use were significant.

Kremlin spokesman Dmitry Peskov also agreed with Minister Siluanov, who strongly stated: Russia will challenge any confiscation in court.

He went on to say that Western countries seizing Russian assets would be “illegal” and “extremely dangerous” for the global financial system and the world economy , adding that any such move would be considered theft. “If something of ours is confiscated, we will consider what we will confiscate and respond immediately,” the Kremlin spokesman warned.

According to official estimates, Russia's central bank reserves are set to fall by 8.4% in 2022 after assets were frozen in G7 countries, the EU and Australia.

As of now, about 210 billion euros ($232 billion) of Russia's foreign exchange reserves are believed to be in the EU, including 191 billion euros in Belgium and 19 billion euros in France, and another 7.8 billion euros are believed to be in non-EU Switzerland. The EU aims to raise 15 billion euros for Ukraine from the proceeds of frozen Russian assets, subject to unanimous approval by all member states. Meanwhile, the US is believed to have frozen about $5 billion in Russian state assets.

In July 2023, the EU's major clearing house, Belgium-based Euroclear, revealed that of the 2.28 billion euros it earned in the first half of 2023, it had accumulated more than 1.7 billion euros in profits from frozen Russian assets. According to estimates, Euroclear holds 196.6 billion euros worth of Russian money, most of which is owned by the country's central bank.

Notably, about 5 million Russian private investors have seen their assets frozen in accounts with international financial institutions. The value of securities frozen in the portfolios of private investors amounted to $3.4 billion as of July 2022.

For months, Western countries have been pondering how to seize the money and transfer it to Kiev, despite numerous warnings that such measures could jeopardize the credibility of the Western financial and monetary system.

EU policymakers have discussed a windfall tax on profits generated from fixed-income funds, which would generate an estimated 3 billion euros in profits. Meanwhile, G7 leaders are expected to discuss a plan to allow the seizure of frozen Russian assets when they meet in February 2024, Reuters reported, citing sources.

Several EU member states have also objected to the idea of using Russia’s frozen funds. According to a recent Financial Times report, countries including France, Germany and Italy remain “extremely cautious” about the idea. Some EU officials “fear possible retaliation” if Russia’s reserves are seized.

The European Central Bank (ECB) has warned against using Russia's frozen foreign exchange reserves, saying it could jeopardize the reputation of the euro.

Source

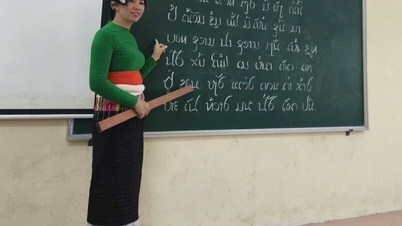

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

Comment (0)