Deputy Prime Minister Pham Thi Thanh Tra signed Decision No. 2671/QD-TTg approving the Plan for reducing and simplifying administrative procedures related to production and business activities under the management of the Ministry of Industry and Trade (second time).

Decision No. 2671/QD-TTg amends and supplements Parts 1, 2, and 3 of the Plan for reducing and simplifying administrative procedures related to production and business activities under the management of the Ministry of Industry and Trade, issued together with Decision No. 1643/QD-TTg dated July 31, 2025.

According to Decision No. 2671/QD-TTg, the Prime Minister has reduced and simplified a number of administrative procedures related to production and business activities in 11 areas under the management of the Ministry of Industry and Trade, including: alcohol production and trading; food safety; tobacco; gas trading; import and export; multi-level marketing; e-commerce; international trade; industrial explosives and explosive precursors; electricity; and chemicals.

Simultaneously, investment and business conditions will be reduced and simplified in the following 12 sectors: alcohol production and trading; tobacco trading; gas trading; petroleum trading; e-commerce; multi-level marketing; import and export; trading of goods and activities directly related to the trading of goods by foreign service providers in Vietnam; electricity activities; industrial explosives and explosive precursors; rice production, trading and export; and chemical trading.

In addition, the Prime Minister approved the reduction and simplification of internal administrative procedures in three areas: oil and gas; border trade; and consumer protection.

50% reduction in fees for assessing eligibility to operate a liquor business.

Regarding the procedures for granting licenses for the production of handcrafted alcoholic beverages for commercial purposes and licenses for the production of industrial alcoholic beverages, the Prime Minister has approved the abolition of the following required documents: a copy of the business registration certificate and a list of alcoholic beverage products accompanied by copies of the labels; simultaneously, the business condition assessment fee and the business operation assessment fee will be reduced by 50%.

Reduce the time taken to process administrative procedures.

The Prime Minister has approved a plan to reduce the time for issuing licenses: from 15 working days for alcohol distribution to 10 days; and from 10 working days for alcohol retail to 7 working days from the date of receiving complete and valid documents.

Reduce the processing time for administrative procedures to issue Certificates of Eligibility for LNG and CNG trading businesses; and Certificates of Eligibility for the production and repair of LPG and mini LPG cylinders from 15 working days to 10 working days.

Reduce the time for issuing Certificates of Eligibility for Rice Export Business from 15 working days to 10 working days; re-issuing or adjusting Certificates of Eligibility for Rice Export Business from 10 working days to 7 working days.

Reduce the processing time for administrative procedures to issue Certificates of Eligibility to act as petroleum distributors from 30 working days to 22 working days from the date of receipt of a valid application.

Abolish certain conditions regarding the distribution and wholesale of alcoholic beverages.

Regarding the conditions for alcohol distribution, the Prime Minister has abolished the following conditions:

- Having a wine distribution system covering at least two provinces or centrally-governed cities (including the area where the company's head office is located);

- Each province and centrally-governed city must have at least one wholesale liquor trader. If a business establishes a branch or business location outside its main office to sell liquor, confirmation from a wholesale liquor trader is not required.

- A letter of introduction or preliminary agreement from another wine producer, wine distributor, or wine supplier abroad is required.

At the same time, the Prime Minister also abolished some conditions regarding the wholesale of alcohol:

- It is a business established in accordance with the law.

- The business must have a wholesale liquor distribution system within the province or centrally-governed city where its head office is located, with at least one liquor retailer.

If a business establishes a branch or business location outside its head office to sell alcoholic beverages, it does not require confirmation from a retail alcoholic beverage dealer.

- A letter of introduction or preliminary agreement from a wine producer, wine distributor, or other wine wholesaler.

Reduce and simplify the conditions for granting licenses for wholesale and retail sale of tobacco products.

Regarding the plan to reduce and simplify administrative procedures for issuing wholesale tobacco product licenses, the Prime Minister abolished the following conditions:

- It is a business established in accordance with the law.

- The business location does not violate the regulations regarding locations where tobacco sales are prohibited, as stipulated in Clause 2, Article 25 of the Law on Prevention and Control of Tobacco Harm 2012.

- There must be a wholesale system for tobacco products in the province where the business is headquartered (with at least two or more tobacco product retailers).

- A letter of introduction from the tobacco product supplier or tobacco product distributor clearly stating the intended business area.

Regarding the conditions for granting a retail tobacco product license, the following conditions have been abolished:

- A letter of introduction from tobacco product distributors or wholesalers clearly stating the intended business area.

- The business location does not violate the regulations regarding locations where tobacco sales are prohibited, as stipulated in Clause 2, Article 25 of the Law on Prevention and Control of Tobacco Harm 2012.

Remove the requirement that businesses operating multi-level marketing schemes must have a charter capital of 10 billion VND or more.

The Prime Minister has approved the abolition of the following requirement for gasoline and diesel fuel dealers, traders, and retail outlets: Management staff and employees directly involved in the business must be trained and certified in fire prevention, firefighting, and environmental protection in accordance with current laws.

According to the recently approved plan, businesses wishing to register for multi-level marketing activities no longer need to meet the following two conditions: having a charter capital of 10 billion VND or more; and having a communication system to receive and resolve inquiries and complaints from multi-level marketing participants.

Many conditions for the temporary import and re-export of frozen food products have been abolished.

Regarding the conditions for the temporary import and re-export of frozen food products, the Prime Minister has abolished the following conditions:

- Warehouses and storage facilities must have a minimum capacity of 100 40-foot refrigerated containers and a minimum area of 1,500m2. The warehouses and storage facilities must be separated from the outside by a solid fence, constructed with a minimum height of 2.5m;

- There are designated roads for container trucks to access the warehouse/yard; there are entrance gates and signage for the business using the warehouse/yard.

- The warehouse/storage facility must have sufficient power supply (including grid electricity and backup generators of equivalent capacity) and specialized equipment to operate the refrigerated containers according to the warehouse/storage facility's capacity.

- Warehouses and storage facilities must be owned by the enterprise or leased by the enterprise under a contract;

- It must be located within the planned area for warehouses and storage facilities serving the temporary import and re-export of frozen food, or within an area designated by the People's Committee of the border province after consultation with the Ministry of National Defense, the Ministry of Finance, and the Ministry of Industry and Trade.

- The bill of lading must be a named bill of lading and is non-transferable.

- The bill of lading must include the business registration number for temporary import and re-export of the enterprise.

- For used goods listed in Appendix IX of Government Decree No. 69/2018/ND-CP dated May 15, 2018, detailing certain articles of the Law on Foreign Trade Management, the bill of lading must include the temporary import and re-export business license number issued by the Ministry of Industry and Trade.

Source: https://www.vietnamplus.vn/cat-giam-mot-so-thu-tuc-hanh-chinh-thuoc-pham-vi-quan-ly-cua-bo-cong-thuong-post1082591.vnp

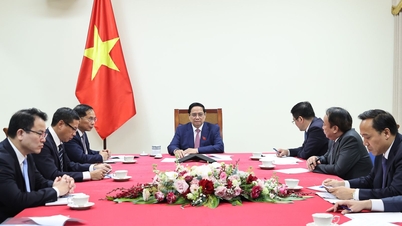

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)