The NGO Urgewald and 17 partners have just released a report on the state of fossil fuel investment in 2023. According to the report, 7,500 institutional investors worldwide hold $4.3 trillion in bonds and stocks of fossil fuel companies in 2023.

At the 2023 United Nations Climate Change Conference (COP28) in Dubai, the international community agreed to move towards phasing out fossil fuels. However, 96% of oil and gas producers are still exploring and developing new oil and gas reserves and increasing annual capital expenditure on oil and gas exploration.

Fossil fuel investors are pushing the world further away from achieving zero CO2 emissions, according to Urgewald. According to Urgewald's assessment, eight of the 10 largest investors in fossil fuels are in the US. The world's largest asset manager is Vanguard with $413 billion and Blackrock with $400 billion.

Japanese and Norwegian sovereign wealth funds also made the top 10. US investors alone hold a total of $2.8 trillion in fossil fuel companies in 62 countries and account for 65% of all institutional investment in fossil fuel companies.

According to environmental activists, compared to Europe, the US does not have strict regulations to prevent or limit investment in the fossil energy sector. Therefore, US investors still hold a lot of shares in fossil fuel companies. The biggest beneficiaries of this investment are also US companies, such as Exxon Mobil, Chevron and Conoco-Phillips.

“If institutional investors continue to support the expansion of coal, oil and gas companies, a timely exit from fossil fuels will be impossible,” warned Katrin Ganswindt, head of financial research at Urgewald.

Climate scientists have long warned that a rapid phase-out of fossil fuels is the only hope of mitigating the effects of climate change on rising global temperatures. Katrin Ganswindt called for a red line to be drawn to prevent further investment in fossil fuels.

KHANH MINH

Source: https://www.sggp.org.vn/chuyen-huong-dau-tu-post748723.html

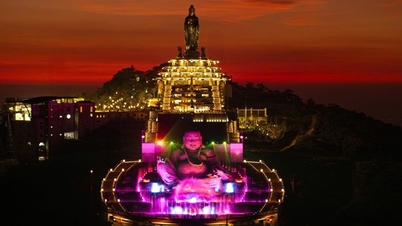

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

Comment (0)