After the record IPO, on December 11, 1.875 billion shares of VPBank Securities JSC ( VPBankS, HoSE: VPX ) will start trading on HoSE with a reference price of VND 33,900/share, with a fluctuation range in the first session of ± 20%.

VPBankS will start trading on HoSE on December 11. Photo: VPBankS

After a sluggish October and November, the stock market is showing clear signs of improvement in both scores and sentiment. The “January effect” is expected to continue to play a supporting role in sentiment and cash flow in the new year.

In the medium and long term, according to SSI Securities, the market in general and VPX shares in particular are being supported by a series of important reforms, the upgrading process and strong growth momentum of the economy .

In addition, VPBankS also possesses many internal factors that help the stock have a positive starting point. The company does not implement ESOP or sell shares to key investors at preferential prices before the IPO, thereby limiting the pressure to take profits early. The IPO also has the participation of large, reputable organizations such as Dragon Capital or VIX Securities - not only contributing to strengthening reputation but also helping the stock to be more stable when listed.

Strong business results also support VPX. In the first 9 months of 2025, VPBankS recorded pre-tax profit of VND 3,260 billion, nearly 4 times higher than the same period; total assets reached more than VND 62,100 billion at the end of the third quarter, outstanding margin loans of nearly VND 27,000 billion, ranking in the top 3 of the securities industry. In the next 5 years, VPBankS aims for a compound growth rate of 32%/year, by 2030 maintaining the leading position in total assets and profits.

Phu Hung Securities (PHS) forecasts that VPX is likely to be considered for addition to some important index baskets such as VNFIN Lead, VN30 and VNFIN Select from 2026, thereby helping to increase its presence in the market, attracting organizations and passive investment funds.

In a broader view, VPBank's listing on HoSE not only helps businesses improve transparency and governance standards, creating a foundation for sustainable growth, but also improves liquidity for investors participating in the IPO, while adding a billion-dollar option in the group of financial and securities stocks on the market.

Mr. Minh

Source: https://baochinhphu.vn/nhung-yeu-to-thuan-loi-khi-co-phieu-vpx-len-san-102251208171034277.htm

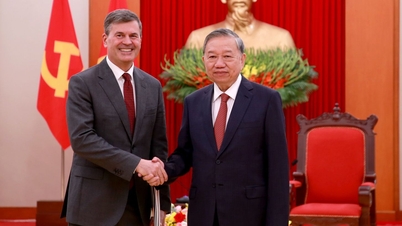

![[Photo] General Secretary To Lam receives the Director of the Academy of Public Administration and National Economy under the President of the Russian Federation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F08%2F1765200203892_a1-bnd-0933-4198-jpg.webp&w=3840&q=75)

Comment (0)