The Ministry of Finance said that it is seeking comments on a draft document on the issuance of a Government Decree detailing land use fees and land rents according to the National Assembly's Resolution on a number of mechanisms and policies to remove difficulties and obstacles in organizing the implementation of the Land Law.

In this draft, the Ministry of Finance proposed that the Government amend Articles 3, 5, 6, 7, 23 and 26 of Decree No. 103/2024 issued previously.

For example, in Article 6, the Ministry of Finance proposed to clarify two cases of calculating land use fees. If the land allocation decision does not include infrastructure construction costs, land use fees are determined by multiplying the land area by the land price for calculating land use fees.

If there are infrastructure construction costs, the amount payable is determined by multiplying the land area by the land price, then subtracting the infrastructure cost per square meter of land. Infrastructure costs are based on construction laws and are clearly stated in the land allocation decision.

In the case of land use purpose conversion, Article 7 is amended to standardize the formula for calculating land use fees after conversion, and clearly stipulate how to determine land prices corresponding to the land use period before conversion.

In Article 26, the Ministry of Finance proposed to amend the method of calculating annual land rental prices and one-time land rental prices for the entire rental period (in case of no auction).

The amendment clarifies two cases: Whether or not there is infrastructure construction cost in the decision to lease land or adjust the form of land use.

For annual land leases, the land rental price is determined based on a percentage rate prescribed by the Provincial People's Committee, multiplied by the land price used to calculate the land rental. The allowed percentage ranges from 0.25% to 3% depending on the area, route and land use purpose.

For land lease with one-time payment, the draft clearly states the formula applied in each case, land price is determined according to the Land Price List, Land Price List combined with adjustment coefficient or specific land price. If the investor has spent the cost of infrastructure construction, the land lease price will be deducted from this cost.

Source: https://congluan.vn/bo-tai-chinh-de-xuat-sua-hang-loat-quy-dinh-ve-tien-su-dung-dat-va-tien-thue-dat-10321729.html

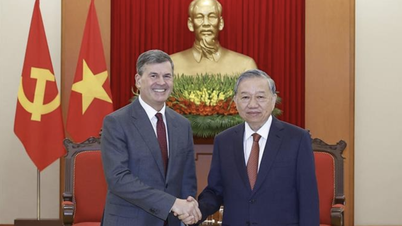

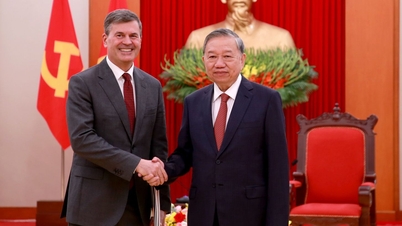

![[Photo] General Secretary To Lam receives the Director of the Academy of Public Administration and National Economy under the President of the Russian Federation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F08%2F1765200203892_a1-bnd-0933-4198-jpg.webp&w=3840&q=75)

Comment (0)