On the morning of December 8, the National Assembly listened to the Report and examination report on: the adjustment of the content of Resolution No. 94/2015/QH13 of the National Assembly on the investment policy of Long Thanh International Airport; the draft Law amending and supplementing a number of articles of the Law on Value Added Tax; the draft Resolution of the National Assembly on specific mechanisms and policies to implement major projects in the capital; the amendment and supplement of Resolution No. 170/2024/QH15 dated November 30, 2024 of the National Assembly on specific mechanisms and policies to remove difficulties and obstacles for projects and land in the conclusions of inspections, examinations and judgments in Ho Chi Minh City, Da Nang City and Khanh Hoa Province.

Promote decentralization and delegation of power

At the meeting, authorized by the Prime Minister, Minister of Construction Tran Hong Minh presented a report on adjusting the content of Resolution No. 94/2015/QH13 of the National Assembly on the investment policy of Long Thanh International Airport.

The Government proposed that the National Assembly consider and adjust the content of Clause 6, Article 2 of Resolution No. 94/2015/QH13 and include it in the content of the Joint Resolution of the 10th Session, 15th National Assembly as follows: "Allowing the Government to organize the approval of the Feasibility Study Report for Phase 2 of the Project under its authority without having to report to the National Assembly for approval."

The National Assembly's Economic and Financial Committee believes that the Government's proposal is well-founded and consistent with current legal regulations and the implementation of the Party's policy on promoting decentralization and delegation of power to meet the country's development requirements in the new era; regulations on promoting decentralization and delegation of power, simplifying and shortening the time for preparing Feasibility Study Reports and deciding on investment in important national projects.

Regarding the proposal to include the content "Allowing the Government to organize the approval of the Feasibility Study Report for Phase 2 of the Project under its authority without having to report to the National Assembly for approval" in the Resolution of the 10th Session of the 15th National Assembly, the Economic and Financial Committee agreed with the Government's proposal, similar to other adjustments related to the Long Thanh International Airport Project that were also decided by the National Assembly in a number of joint Resolutions at previous sessions. In addition, some opinions suggested that the Government take responsibility for the proposed contents, ensuring the correct progress, quality and investment efficiency of the Project.

Do not create loopholes, causing loss of revenue to the budget

Based on political and legal grounds and from the analysis of difficulties as well as practical context, the draft Law amending and supplementing a number of articles of the Law on Value Added Tax stipulates the value added tax policy for agricultural products, animal feed, input value added tax deduction and tax refund conditions in Clause 1, Article 5, Clause 5, Article 9, Article 14 and Clause 9, Article 15 of the Law on Value Added Tax No. 48/2024/QH15.

Specifically, to continue to support and facilitate enterprises, cooperatives, and cooperative unions in agricultural product trading activities and support farmers in product consumption, the Government proposes to supplement Clause 1, Article 5 on non-taxable subjects (this content was previously stipulated in Clause 1, Article 1 of Law No. 106/2016/QH13 and was abolished in Value Added Tax Law No. 48/2024/QH15) and add 1 clause (Clause 3a) in Article 14 on input value added tax deduction of Value Added Tax Law No. 48/2024/QH15.

To contribute to the goal of immediately removing "bottlenecks" in 2025, the Government proposed to remove the regulation on tax refund conditions (buyers are only entitled to tax refunds when sellers have declared and paid taxes) at Point c, Clause 9, Article 15 of the Law on Value Added Tax No. 48/2024/QH15...

The review report of the Economic and Financial Committee clearly stated that many opinions in the Committee believe that it is necessary to carefully consider the necessity of amending and supplementing the Law at this Session. Because the provisions of the Law as well as the guiding documents under the Law have just been implemented for a short time, there is not enough time needed to conduct a comprehensive summary and assessment of the implementation of the Law. Many opinions believe that the basic problem still comes from the problem of delay in VAT refund.

Therefore, it is necessary to carefully consider and evaluate each specific proposal of the enterprise; consider which content needs to be amended in the Law, which content is implemented by the organization and needs to be amended in the sub-Law documents.

The amendment cannot be too biased towards the goal of facilitating businesses, but instead creates loopholes, causing loss of revenue to the budget and not ensuring Regulation No. 178-QD/TW on controlling power and preventing corruption and negativity in law-making work.

Promoting the rapid, sustainable and modern development of the Capital

Presenting the Government's Report, Minister of Finance Nguyen Van Thang said that the issuance of the National Assembly's Resolution allowing Hanoi to pilot a number of specific mechanisms and policies to implement large and important projects in the capital is necessary and urgent to clear legal "bottlenecks", attract investment, create breakthroughs, develop faster, more sustainably, and have greater spillover effects in the economic development of the Red River Delta and the whole country.

The Resolution will create a solid foundation for the Capital to achieve an average economic growth rate of 11% per year or more, while also meeting the requirements of innovative management thinking, strengthening decentralization and delegation of power to the Capital in the spirit of Resolution No. 66-NQ/TW dated April 30, 2025 of the Politburo.

The Draft Resolution is structured into 12 Articles; regulating the piloting of a number of specific mechanisms and policies, superior to a number of current laws on important issues such as: Authority to decide and approve investment policies;

On selecting investors and contractors; Policies on planning and architecture; Land recovery, land allocation and land lease; Mechanism for mobilizing capital for project implementation; Measures to ensure urban order, social order and safety; Measures for urban renovation, embellishment and reconstruction.

The Draft Resolution stipulates many policies to simplify administrative procedures through decentralization of authority and integration of many parallel implementation steps.

Specifically, decentralize the authority to decide and approve investment policies; organize simultaneous implementation of procedures; shorten the process of planning establishment and adjustment; simplify procedures in land recovery, land allocation, and land leasing.

Briefly presenting the review report, Chairman of the Economic and Financial Committee Phan Van Mai said that the Committee agreed with the necessity, political basis and practical basis of building and promulgating the Resolution according to shortened procedures, in order to institutionalize the Politburo's policy, contributing to removing institutional bottlenecks, mobilizing resources, promoting the rapid, sustainable, modern development of the Capital, with regional and national radiance.

For special mechanisms and policies with a large scope of impact such as expanding land recovery cases (Clause 2, Article 7), decentralizing the authority to decide and approve investment of the National Assembly and the Prime Minister to Hanoi city (Article 4), exceeding the credit ceiling (Clause 2, Article 8), enforcement when reaching 75% consensus (Clause 4, Article 10), to ensure sufficient legal and political basis, the appraisal agency recommends reporting to competent authorities, carefully assessing legal, economic and social impacts, ensuring that no complicated complaints or lawsuits arise, affecting social stability and people's trust, in accordance with the Constitution and the Party's policies.

Expanding the application of special mechanisms to remove obstacles for land projects

According to the Government's Submission, the Government submitted to the National Assembly for consideration and promulgation a Resolution of the National Assembly expanding the scope of application of Resolution No. 170/2024/QH15 dated November 30, 2024 on specific mechanisms and policies to remove difficulties and obstacles for projects and land in inspection, examination and judgment conclusions in Ho Chi Minh City, Da Nang City and Khanh Hoa Province for projects and land in inspection, examination and judgment conclusions with similar legal situations nationwide.

The draft Resolution ensures decentralization, delegation of power, and enhancement of local responsibility for implementation; is timely, flexible, and feasible; and immediately resolves urgent problems; does not legalize violations; prevents and combats corruption, negativity, and waste; and strictly handles the responsibilities of relevant individuals and groups according to regulations. At the same time, it is consistent with objective reality and specific historical circumstances; harmonizes the interests of the State, people, and investors; protects the legitimate rights and interests of relevant parties; ensures security, order, and social safety; does not give rise to disputes and complaints, especially disputes involving foreign elements.

The subjects of application of the Resolution are similar to Resolution No. 170/2024/QH15 dated November 30, 2024; additional provisions are added for projects and land whose time of violations and violations is determined in the inspection, examination and judgment conclusions before the effective date of this Resolution to avoid continuing to handle newly arising violations.

The Economic and Financial Committee agreed with the necessity, political basis, legal basis, and practical basis of issuing the Resolution as presented by the Government; emphasizing that the issuance of the Resolution aims to institutionalize the Party's policy on removing obstacles for projects that have been concluded by inspection, examination, and judgment nationwide, thoroughly resolving long-standing backlog projects, unblocking investment resources, and maximizing the value of land resources.

The Economic and Financial Committee basically agrees with the assignment of the Government to promulgate a list of projects and land in the conclusions of inspections, examinations, and judgments with similar legal situations; and at the same time proposes to clearly stipulate as follows: "The Government is assigned to prescribe guidelines and organize the implementation of this Resolution; promulgate a list in the conclusions of inspections, examinations, and judgments with similar legal situations as prescribed in Clause 1, Article 1 of this Resolution and take full responsibility for the accuracy, completeness, and honesty of the list of projects and land...."

In this morning's session, the National Assembly listened to the Submission and Verification Report on the second round of state budget supplementation (foreign non-refundable capital) in 2025./.

Source: https://www.vietnamplus.vn/thao-go-diem-nghen-the-che-thuc-day-phat-trien-thu-do-nhanh-ben-vung-hien-dai-post1081670.vnp

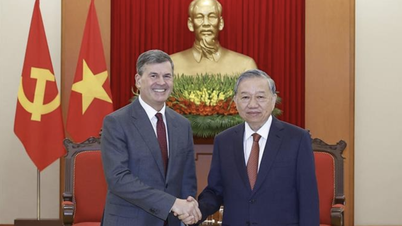

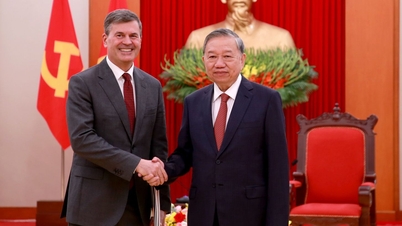

![[Photo] General Secretary To Lam receives the Director of the Academy of Public Administration and National Economy under the President of the Russian Federation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F08%2F1765200203892_a1-bnd-0933-4198-jpg.webp&w=3840&q=75)

Comment (0)